Record year in store as June biodiesel imports highest since 2013

Photo: Genscape Inc.

July 13, 2016

BY Will Martin

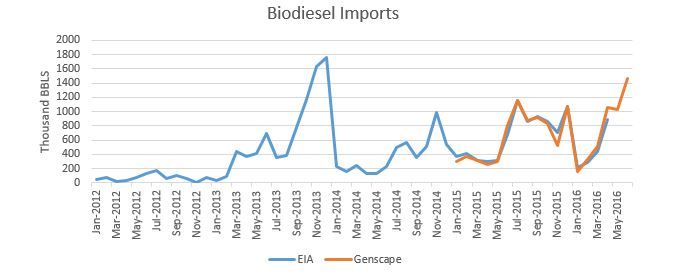

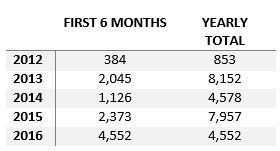

On June 29, the Ardmore Seahawk delivered its second load of Argentine biodiesel to Jacksonville, Florida. The shipment of 35,000 barrels (1.47 million gallons) capped off an unusually active June in what is shaping up to be an unusually active year for biodiesel imports. For the full month, Genscape’s Biodiesel Imports Monitor tracked 1.46 million barrels (61.32 million gallons) of biodiesel imports into the U.S. (this value includes only vessels, so additional imports in June from Canada shipped by rail—data that will not be available for another four weeks—may add to this figure). That brings the total for the first six months of the year to a record 4.5 million barrels (189 million gallons). Typically, the majority of biodiesel import activity occurs in the later months of the year. If this pattern holds in 2016, there is a very good chance that this year will surpass 2013 to have the highest volume of biodiesel shipments on record.

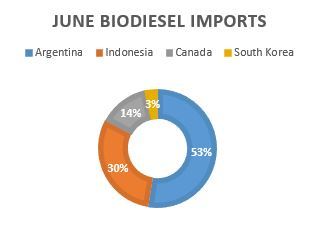

The Ardmore Seahawk was not the only vessel bringing soy-based Argentine biodiesel to the U.S. In total, 769,000 barrels (32.3 million gallons), or just over half of June imports, originated in Argentina. While Argentina continues to be the largest importer, shipments from Asia are becoming increasingly significant. The 443,000 barrels (18.6 million gallons) of June imports that originated in Indonesia is a monthly record. D6 RIN prices are only a few cents below D4 prices, which makes it increasing attractive for Indonesian producers to ship their palm-based biodiesel to the U.S. At current prices, their RIN premium is an incredible $1.84 per gallon. On top of this, producers usually share in the $1-per-gallon blender’s tax credit that was renewed earlier this year.

Interestingly, the drivers for increased imports seem to be almost entirely related to the RFS, and not California’s LCFS. Of the 26 biodiesel shipments, only two were destined for California. Renewable diesel imports, which are also tracked in Genscape’s Biodiesel Imports Monitor, continue to play a much larger role in the LCFS market. Palm-based Indonesian biodiesel cannot generate credits in the LCFS market, and Argentine soy-based biodiesel has a carbon intensity score that makes it uncompetitive with other diesel substitutes. Meanwhile, RFS RVOs for 2016 and 2017 require significant increases in biodiesel consumption. If this trend continues to keep RIN prices high, it’s unlikely that imports will slow down any time soon.

Advertisement

Advertisement

Using Genscape Vesseltracker AIS data and proprietary ship tracking, the Global Biodiesel Monitor provides stakeholders with access to key international shipment information to deliver a more complete picture of biodiesel and renewable diesel flows worldwide. Click here for more information.

Author: Will Martin

Advertisement

Advertisement

Agriculture and Biofuels Analyst, Genscape Inc.

502-238-1684

wmartin@genscape.com

Related Stories

Montana Renewables LLC has delivered its first shipment of 7,000 gallons of SAF to Dearborn, Michigan's Buckeye Pipeline facility. From there, the fuel will be transported to the Detroit Metropolitan Airport via pipeline for use by Delta Air Lines.

NYC took a monumental step towards clean air and a sustainable future on Jan. 11 with the grand opening of the city's first retail fuel station dispensing renewable diesel. The project is a collaboration between Sprague and Sonomax.

The USDA on Jan. 11 awarded $19 million under the Higher Blend Infrastructure Incentive Program. The grants will support projects in 22 states to expand the availability of higher ethanol and biodiesel blends.

Jet Aviation partners with World Fuel Services to offer SAF in Bozeman, Montana, and Scottsdale, Arizona

Jet Aviation announced on Dec. 22 that it has signed an agreement with World Fuel Services to secure and offer sustainable aviation fuel (SAF) on-site at its FBOs in Bozeman, Montana, and Scottsdale, Arizona, effective immediately.

Neste has partnered with Coleman Oil Company, a leading provider of fuels, biofuels, lubricants, and related products, to enable cities and businesses to have easier access to Neste MY Renewable Diesel in the state of Washington in the U.S.

Upcoming Events