Renewable diesel made up 10 percent of Calif. diesel supply in Q2

Image: U.S. EIA, based on California Air Resources Board

November 15, 2018

BY Ron Kotrba

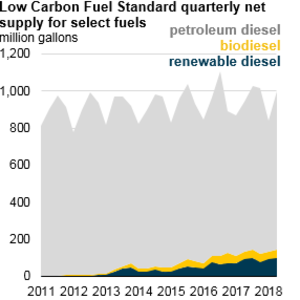

The net supply of renewable diesel to California’s fuel market reached 100 million gallons during the second quarter of this year, topping 10 percent of the total diesel supplied to the state in that quarter, according to a new report from the U.S. Energy Information Administration.

Driving demand for low-carbon fuels like renewable diesel and biodiesel is, naturally, the state’s Low Carbon Fuel Standard, which regulates and incrementally reduces greenhouse gas emissions from motor fuels by 20 percent through 2030 compared to a 2010 baseline (originally 10 percent by 2020) by assigning carbon intensities to various fuels.

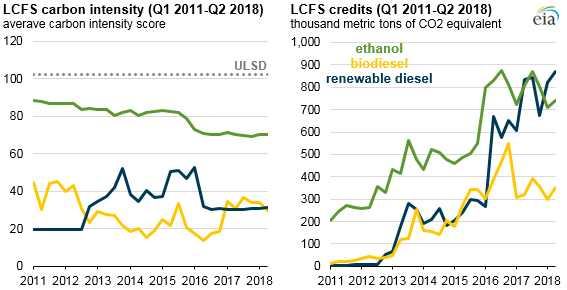

Carbon intensity is measured in grams of carbon dioxide equivalent per megajoule (gCO2e/MJ), and the average carbon intensity of renewable diesel is about 30 gCO2e/MJ, which is approximately the same as biodiesel’s average carbon intensity. Ethanol, however, averages roughly 50 gCO2e/MJ. Ultra-low sulfur diesel averages about 102 gCO2e/MJ.

Advertisement

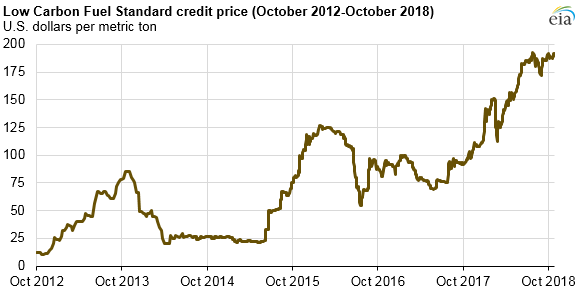

Low-carbon fuels generate credits that can be bought, sold and traded by regulated parties to meet requirements. According to the EIA, the total volume of LCFS credits associated with renewable diesel exceeded that of fuel ethanol for the first time in 2018, reaching about 870,000 metric tons of carbon dioxide equivalent during the second quarter.

“While renewable diesel imports from Singapore remain significant, planned renewable diesel production capacity additions during the next several years have the potential to increase the share of domestic renewable diesel in the California market,” the EIA report states.

Advertisement

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events