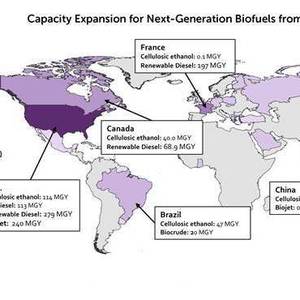

Report: Biofuels capacity to grow to 61 BGY in 2018

Image: Lux Research

September 22, 2015

BY Lux Research

Global biofuels capacity will grow to 61 billion gallons per year (BGY) in 2018, up from 55.1 BGY in 2014. Ethanol and biodiesel will continue to dominate with 96 percent of the capacity in 2018, but novel fuels and novel feedstocks will be major drivers of capacity growth, according to Lux Research.

Novel fuels and novel feedstocks will grow at a rapid 27 percent and 16 percent compound annual growth rate (CAGR), respectively, through 2018. Ethanol and biodiesel will grow at a slower 2 percent rate but will reach capacities of 40 BGY and 19 BGY, respectively.

“While ethanol and biodiesel dominate global biofuel capacity today, limits on their growth mean that novel fuels like renewable diesel, biojet fuel and biocrude are crucial to the future of the industry,” said Victor Oh, Lux Research associate and lead author of the report titled, “Biofuels Outlook 2018: Highlighting Emerging Producers and Next-generation Biofuels.”

Advertisement

Advertisement

“Producers also need to tap into novel feedstocks like waste oils, nonedible biomass, and municipal solid waste to push the industry beyond food-vs.-fuels competition,” he added.

Lux Research analysts studied growth of biofuels utilizing an alternative fuels database of more than 1,800 production facilities globally. Among their findings:

-Waste oils will dominate next-generation biofuels. With a 52 percent share, biodiesel made from novel feedstock, specifically waste oils, will lead novel fuels capacity in 2018. Cellulosic ethanol and renewable diesel follow with 19 percent and 18 percent, respectively.

-Americas continue dominance. With a 64 percent share of global biofuels capacity, the Americas are a dominant force. The region, led by the U.S. and Brazil, also leads in utilization of global production capacity with 86 percent, much higher than the global average of 68 percent in 2014.

Advertisement

Advertisement

-Eight countries are biggest emerging producers. China, Indonesia and Thailand in Asia; Colombia and Argentina in the Americas; and Portugal, Poland and France in Europe are the biggest emerging production centers for biofuels after the U.S. and Brazil.

The report is part of the Lux Research Alternative Fuels Intelligence service.

Related Stories

At the University of Missouri, plant biochemist Jay Thelen is using arabidopsis as a powerful model to explore ways to boost oil production — an important step toward creating more sustainable, plant-based energy sources.

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Total U.S. operable biofuels production capacity expanded in May, with gains for renewable diesel and a small decrease for ethanol, according to data released by the U.S. Energy Information Administration. Feedstock consumption was up.

The U.S Department of Energy Bioenergy Technologies Office, in partnership with the Algae Foundation and NREL, on July 21 announced the grand champion and top four winning teams of the 2023 - 2025 U.S. DOE AlgaePrize Competition.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

Upcoming Events