Report: China’s biobased diesel production to fall in 2024

SOURCE: USDA FAS GAIN

September 18, 2024

BY Erin Voegele

A report filed with the USDA Foreign Agricultural Service’s Global Agricultural Information Network discusses how China’s domestic biobased-diesel industry has been impacted by the European Union’s provisional antidumping duties on biodiesel and renewable diesel.

The EU earlier this year imposed provisional antidumping duties of up to 36.4% on biodiesel and hydrogenation-derived renewable diesel (HDRD). According to the report, China in March 2024 launched a process to modify B5 biodiesel national standards as part of its effort to prepare for the biobased diesel consumption transition from export-oriented to domestic-oriented.

The report notes that biodiesel in China is currently primarily used for environmentally friendly plasticizer, electric power generation, fishing vessels, and farm equipment. On-road transport currently accounts for over one-third of total biodiesel demand in the country.

Advertisement

China currently has 48 biodiesel plants with a combined 4 billion liters (1.06 billion gallons) of capacity, compared to 48 facilities with 3.7 billion liters of capacity in 2023 and 46 facilities with 3.5 billion liters of capacity in 2022. Capacity use is expected to reach 49% in 2024, compared to 60% last year and 43% in 2022.

The country also currently has 14 HDRD facilities with a combined 2.5 billion liters of capacity, compared to 12 facilities with 2.2 billion liters of capacity last year and 11 facilities with 2 billion liters of capacity in 2022. HDRD capacity use is expected to fall to 36% this year, compared to 45% last year and 47% in 2022.

Biobased diesel production is expected to reach 2.85 billion liters this year, including 910 billion liters of HDRD production. Biobased diesel production was at 3.235 billion liters in 2023 and 2.43 billion liters in 2022, with HDRD production at 1 billion liter and 940 million liters, respectively.

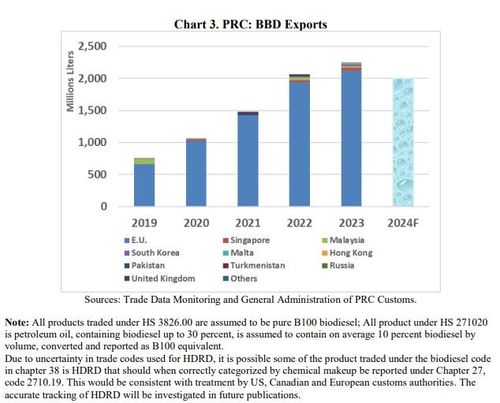

Biodiesel diesel exports are expected to fall to 2 billion liters this year, down from 2.776 billion liters in 2023 and 2.054 billion liters in 2022. Exports are expected to include 840 million liters of HDRD this year, down from 900 million liters in both 2022 and 2023.

Advertisement

Biobased diesel imports are forecast at 50 million liters in 2024, down from 291 million liters in 2023 and 358 million liters in 2022.

Used cooking oil is the feedstock currently used to produce biobased diesel in China, with 1.897 million metric tons expected to go biodiesel production this year and 890,000 metric tons expected to go to HDRD production.

The biodiesel blend rate for 2024 is expected to reach 0.3% this year, up from 0.2% in both 2022 and 2023.

A full copy of the report is available on the USDA FAS GAIN website.

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

Upcoming Events