Rex American Resources releases third quarter financial results

Rex American Resources Corp.

December 2, 2015

BY Erin Krueger

Rex American Resources Corp. has released fiscal third quarter financial results, reporting net sales and revenue of $110.6 million for the three-month period ended Oct. 31, down from $138.4 million reported for the same period of last year. The company primarily attributed the drop to reduced ethanol pricing.

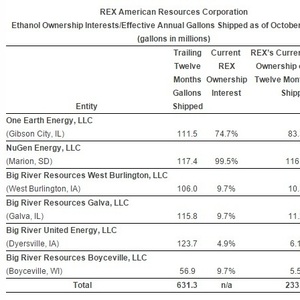

According to Rex, its third quarter results reflect its interests in six ethanol plants, compared to seven during the same period of last year, as its interest in Patriot Holdings LLC was sold during the second quarter of this year. The operations of One Earth Energy LLC and NuGen Energy LLC are consolidated, with the four remaining plants reported as equity in income of unconsolidated ethanol affiliates.

Gross profit for the third quarter was $14.3 million, compared with $36.5 million during the same quarter of the prior year. Equity in income of unconsolidated ethanol affiliates was $1.3 million, compared to $8.8 million during the third quarter of 2014 primarily as a result of the same industry and pricing factors that impacted the company’s consolidated ethanol production facilities as well as the inclusion in the year-ago period of $4.2 million from its interest in Patriot. As a result, Rex indicated income from continuing operations before income taxes and non-controlling interests during the third quarter totaled $11.1 million, down from $40.6 million during the same period of 2014.

Advertisement

Advertisement

Net income attributable to Rex shareholders for the quarter was $7.5 million, down from $23.3 million during the third quarter of last year. Third quarter diluted net income per share attributable to Rex common shareholders was $1.08 per share, down from $2.86 per share during the same three-month period of 2014, inclusive of a 2 cent benefit from discontinued operations.

“The third quarter operating environment remained challenging as reflected by the industry-wide year-over-year decline in ethanol crush spread margins,” said Stuart Rose, executive chairman of Rex. “Notwithstanding the current environment, as well as the sale of our interest in Q2 of one of our unconsolidated facilities, REX again leveraged the operational efficiencies and strategic locations of our plants in Q3 and benefited from our elimination of outstanding plant-level debt in fiscal 2014. Our disciplined operating practices and business model, combined with our share repurchase activity, led to Q3 diluted EPS of $1.08 and fiscal 2015 year-to-date diluted EPS of $3.72. In fiscal 2015 to date, we have returned approximately $60.1 million to shareholders through a continuation of our long-term share repurchase program.”

During an investor call to discuss the quarterly results, Rose noted that the ethanol crush spreads remained steady during the quarter, down from last year, but approximately the same as the second quarter.

Advertisement

Advertisement

According to Rose, the company spent approximately $10 million this year and plans to spend another $15 million to $20 million next year to increase its capacity by 15 percent.

According to Rex, its average ethanol selling price for the quarter was $1.44 per gallon, down from $1.89 per gallon during the third quarter of 2014. The average per ton selling price for dried distillers grains was $146.64, up from $145.87 during the same period of last year. Non-food grade corn oil averaged a selling price of 26 cents per pound during the third quarter, down from 31 cents per pound during the same period of last year. The per-ton price of modified distllers grains was $56.40 per ton, up from $41.78 per ton last year. The average cost of grain was $3.62 per bushel, down slightly from $3.64 per bushel during the third quarter of 2014. Natural gas prices were also down, reaching $3.21 mmBtu during the third quarter, compared to $4.69 per mmBtu during the same three-month period of 2014.

Related Stories

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Upcoming Events