Rex reports strong Q4, predicts more challenging Q1

March 24, 2022

BY Erin Krueger

Rex American Resources Inc. released fiscal fourth quarter results on March 23, reporting a significant increase in sales revenue for the three-month period, but cautioning that high corn prices and other factors are likely to negatively impact 2022 results.

Douglas Bruggeman, chief financial officer of Rex, said sales for the fiscal fourth quarter, the three-month period ending Jan. 31, were up 68 percent due to higher pricing for ethanol, distillers grains and corn oil. The company sold 69.9 million gallons of ethanol during the period, up from 67.7 million gallons during the same quarter of the previous year.

Advertisement

Advertisement

Stuart Rose, executive chairman of Rex, said the company had a “very good” fiscal 2021 but said Rex is projecting a possible loss for the fiscal first quarter of 2022 due, in part, to higher corn prices. He also cited logistical issues, inflation and labor shortages as other factors negatively impacting the company’s business.

High ethanol stocks are among those factors, according to Zafar Rizvi, CEO of Rex. He cautioned that these factors may persist beyond the first quarter, adversely impacting production and net income.

Rizvi also discussed the ongoing carbon capture and sequestration (CCS) project that Gibson City, Illinois-based One Earth Energy is developing with the University of Illinois. He stressed that the project is still in a very preliminary stage but noted a first test well has already been drilled. Testing at that well is expected to continue over the next several months in support of the Class 6 permit needed to develop a commercial CCS project. In addition, Rizvi said that 3D seismic testing was completed in February, resulting in the collection of 160 million data points that are now being analyzed. He also noted that a FEED study has been completed and the company plans to start a bidding process once engineering is complete.

Advertisement

Advertisement

Rex reported net sales and revenue of $212 million for the fiscal fourth quarter, up from $126 million during the same period of 2020. Net income attributable to Rex shareholders was $21.4 million, compared to $3.5 million. Basic and diluted net income per share attributable to Rex common shareholders was $3.61 compared to a net income per share of 59 cents during the fourth quarter of 2020.

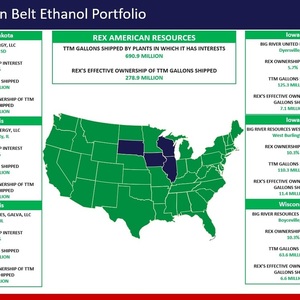

Rex currently holds ownership interest in six ethanol plants, including 75.4 percent ownership interest in Gibson City, Illinois-based One Earth Energy LLC, 99.5 percent ownership interest in Marion, South Dakota-based NuGen Energy LLC, 10.3 percent ownership interest in West Burlington, Iowa-based Big River Resources West Burlington LLC, 10.3 percent ownership interest in Galva, Illinois-based Big River Resources Galva LLC, 5.7 percent ownership interest in Dyersville, Iowa-based Big River United Energy LLC, and 10.3 percent ownership interest in Boyceville, Wisconsin-based Big River Resources Boyceville LLC.

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Upcoming Events