RFA seeks update on EPA feedstock audits, urges tighter regulations on imported UCO, tallow

SOURCE: Renewable Fuels Association

September 17, 2024

BY Renewable Fuels Association

In a letter sent today to U.S. EPA Administrator Michael Regan, the Renewable Fuels Association asked for an update on the agency’s investigation of certain biofuel feedstock imports and urged the adoption of more stringent feedstock verification requirements for imported used cooking oil and tallow.

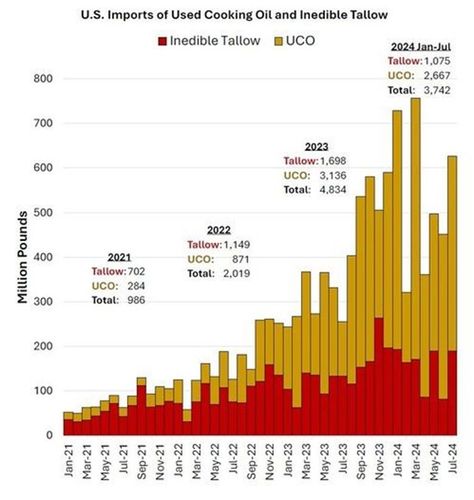

“The recent surge in imports of questionable used cooking oil (UCO) and tallow for biomass-based diesel (BBD) production is suppressing demand and values for domestically produced feedstocks like distillers corn oil and soybean oil, as well as the crops from which those oils are derived,” wrote RFA President and CEO Geoff Cooper, noting that monthly tallow and UCO imports combined have jumped twelvefold since January 2021.

Advertisement

“Today, nearly one out of every six gallons of U.S.-produced BBD is made from imported UCO or tallow—most of which comes from China and Brazil, two countries that maintain punitive import tariffs on U.S. biofuels.”

In early August, EPA confirmed that it was conducting audits of supply chain documentation for certain imported feedstocks, including UCO, used to produce renewable fuel and generate credits under the Renewable Fuel Standard. Since then, there has been no word from the agency about the outcome of the audits.

“In the event that EPA has completed its investigation, we respectfully ask that the Agency publicly share its findings and information regarding any corrective actions being taken,” Cooper wrote. “If the audits are not yet complete, we ask that the Agency share an update with the public on its progress and an estimated timeline for completion.”

Advertisement

Cooper stressed RFA’s concerns that current regulations, especially recordkeeping requirements, are overly lax and “are insufficient to assure the legitimacy of certain imported waste oils, fats, and greases.” RFA called on EPA to engage a standards developing organization to develop test methods to conclusively and quickly differentiate various fats, oils, and greases, just as EPA requires for the differentiation of co-processed starch and cellulosic feedstock from in situ ethanol fermentation. He concluded:

“Without action by EPA to tighten its verification and recordkeeping requirements, the deluge of questionable imports of UCO and tallow not only threaten to inflict further economic harm on U.S. farmers and biofuel producers, but also to undermine the integrity of the RFS program.”

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events