SDSU study maps western expansion of Corn Belt

February 21, 2013

BY Susanne Retka Schill

It is no secret that corn acres have been expanding in response to strong prices. Researchers with the Geographic Information Science Center of Excellence at South Dakota State University in Brookings used USDA satellite land cover data to put some numbers behind those observations and map the conversion of grass-dominated land. The Renewable Fuels Association, however, questioned the linkages made to that conversion and biofuels.

The report, “Recent land use change in the Western Corn Belt threatens grasslands and wetlands,” was published online by the National Academy of Sciences.

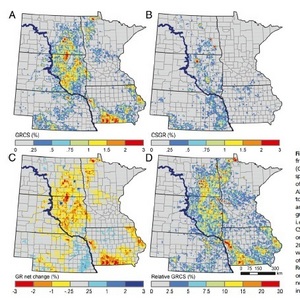

In the study, Christopher Wright, postdoctoral fellow, and Michael Wimberly, professor at the GIS center, characterize patterns of grassland conversion as observed in satellite imagery in five states from 2006 to 2011, which they explain includes conversion from several types of grasslands. Given their spectral similarity, the different types of grass cover—conservation reserve program acres, pasture, hay land as well as native prairie—are hard to distinguish when using satellite imagery.

The authors estimate a net loss of about 1.3 million acres in all types of grassland in the five states. “Grassland conversion between 2006 and 2011 was mostly concentrated in North Dakota and South Dakota, east of the Missouri River,” the authors found, noting that the expansion was occurring in climate zones with greater drought risk than the traditional Corn Belt that might be supported by federal crop insurance. Similar westward expansion of the Corn Belt was found in Nebraska, although it was more evenly distributed and suggested an expansion in irrigated acres in the southwest. In Minnesota and Iowa, grassland conversion formed a ring around the core corn/soybean regions. “Here crop production has expanded not into a less suitable climate per se, but rather onto less suitable land.”

Advertisement

Advertisement

With CRP enrollment declining, the researchers compared their data with county-level CRP information. They found that in North Dakota, decreases in CRP enrollment generally exceeded grassland conversion, suggesting grassland conversion might be largely attributed to a resumption of cropping on CRP lands. In far eastern North Dakota, eastern South Dakota and Nebraska, grassland conversion generally exceeded changes in CRP, however.

Wright said the work was intended to “put some numbers on what everybody knows is going on.” While some might want to use the report to implicate corn ethanol, he said that was not the intent. “We don’t want to make claims on why the change happened and we don’t want to make forecasts.” He would welcome the report being used, though, in support of keeping the Conservation Reserve Program. “I think it’s a good argument for CRP and perhaps for increasing the payments to remove an incentive for conversion.”

Geoff Cooper, vice president, research and analysis for the Renewable Fuels Association, was highly critical of the study. In a blog on the RFA website shortly after the study’s release, Cooper points out that using other USDA data would reach other conclusions. “In fact, total planted cropland in the five states in 2011 was the lowest since 1995. Total planted acres in 2011 for the five-state area were 3.6 percent below the 10-year average (2001-2010).”

He also pointed out that current law “strictly prohibits the conversion of sensitive ecosystems to cropland. At least once a year, farmers must certify that they are complying with the highly erodible land conservation and wetland conservation requirements (the so-called ‘sodbuster’ and ‘swampbuster’ provisions) of the Farm Bill.” Furthermore, the Energy Independence and Security Act revising the renewable fuel standard specifies that feedstocks coming from lands converted to cropland after 2007 do not qualify for the RFS.

Advertisement

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

Upcoming Events