Some shale gas plays not currently economic

December 12, 2013

BY Ben Straus, U.S. Energy Services

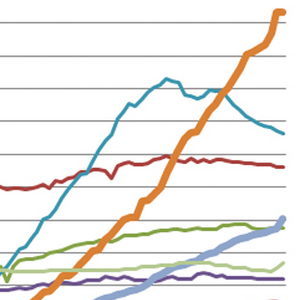

Over the past five years, the United States has experienced rapid growth in oil and natural gas production. The driving force behind this supply renaissance is the improvement of well development processes in the form of directional drilling and hydraulic fracturing of shale deposits. For many in the industry, the large narrative is well known and understood. The ability to access energy from shale will drive down the cost of production for energy intensive industries and reduce domestic reliance on foreign oil. In the case of natural gas, however, despite rapid growth in production over the past five years, the story is a little more complicated below the surface.

Almost all shale wells produce some level of natural gas and oil, but the balance of production—more oil and less gas or vice versa—varies across the different shale plays. If a shale tends to favor natural gas production rather than oil, it is typically referred to as a dry play, where locations that tend to produce a higher proportion of heavier hydrocarbons like propane, butane, natural gasoline or crude oil are typically referred to as wet. The old saying in commodities is that “low prices are the cure for low prices.” In 2012, when the average price of natural gas was below $3 per MMBtu, many shale plays that had been driving production growth were suddenly no longer economic. Even at current price levels, many of the dry shale plays remain uneconomic and the rate of drilling and production has slowed.

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Kintetsu World Express Inc. has signed an additional agreement with Hong Kong, China-based Cathay Pacific Airways for the use of sustainable aviation fuel (SAF). The agreement expands a three-year partnership between the two companies.

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

Upcoming Events