Strong cash market, user margins support corn prices

SOURCE: USDA and Jason Sagebiel

November 25, 2014

BY Jason Sagebiel, Intl FCStone

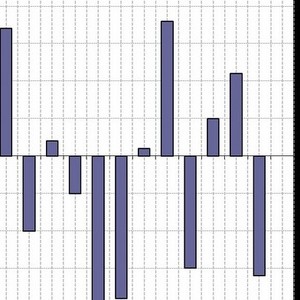

The corn market has found support from positive end-user margins and a strong cash market. Ethanol remains very choppy in the spot market, with margins moving accordingly. The nearby spot ethanol market is allowing ethanol processors to be more aggressive in buying corn that, so far, has been slow to enter the marketplace. This year’s harvest has been dawdling, thus giving producers plenty of time to place corn in strategic places. This year, with a record yield, the producer has been granted an opportunity to utilize his storage to its fullest potential.

USDA’s November supply and demand estimates surprised the trade with a 0.8 per bushel lower yield estimate to place production at 14.407 billion bushels. With old crop carryout of 1.236 billion bushels, total supply is estimated at 15.668 billion bushels, up from 14.782 a year ago. Demand was calculated at 13.660 billion bushels. The ethanol sector increased usage from the previous projection by 25 million bushels at 5.150 billion bushels. Exports remained steady at 1.75 billion bushels, a decrease from last year. Larger global stocks and stronger U.S. dollar will pare demand. The feed sector is expected to use 5.375 billion bushels versus 5.13 billion bushels a year ago. The end result is a carryout sitting just above 2.0 billion bushels. World corn carryout jumped from 137.78 million metric tons a year ago to 172.99 million metric tons, thus limiting U.S. exports.

The trade will look to the January USDA report for the final U.S. yield. In 2009, the previous record year, yield estimates from November to final increased by 1.8 bushels. That was the biggest increase since 1992 when the yield increased by 2.2 bushels per acre. Traders will look at the January report from two perspectives: any changes to yield and acreage.

|

December Corn Futures |

|||

|

Date |

High |

Advertisement

Advertisement

Low

Close

November 24, 2014

3.72 3/4

3.65 1/2

3.67 1/2

October 24, 2014

Advertisement

Advertisement

3.65

3.52 1/4

3.53

November 25, 2013

4.26 1/2

4.22 1/4

4.24 3/4

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

Upcoming Events