Summertime E15 ban would cause severe impact to rural economy

August 4, 2021

BY Renewable Fuels Association

The recent D.C. Circuit Court decision overturning EPA’s approval of year-round E15 sales could have a strongly negative impact on the rural economy and environment in the coming years unless action is taken to allow unimpeded sales of E15 all year long, the Renewable Fuels Association reported in a new analysis released today.

According to the white paper, if the court decision is allowed to stand and no other action is taken to facilitate continued year-round sales of E15 in conventional gasoline areas, the ruling could have considerable long-term impacts on the ethanol market. E15 sales volumes in 2022-2024 would remain essentially flat with 2021 levels, rather than growing rapidly as expected prior to the court decision.

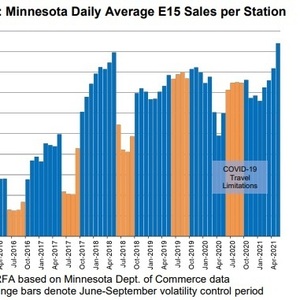

“Some major fuel retailers and marketers who have expressed interest in offering E15 have indicated to RFA that they are much less likely to invest in E15 if they aren’t able to sell the fuel year-round,” wrote RFA Chief Economist Scott Richman. “In addition, if the court ruling stands, E15 sales volumes per station would likely return to pre-2019 levels, as retailers would again be forced to forgo E15 sales during the busy summer driving season and consumers may be confused about fuel offerings.”

As a result of the court decision, RFA particularly noted:

Advertisement

Advertisement

•Cumulative E15 sales between 2021 and 2024 would be nearly 12.6 billion gallons lower than would have been the case if E15 can be sold year-round.

•This leads to a net loss of ethanol sales of 630 million gallons valued at $1.3 billion between 2021 and 2024.

•In addition, the ethanol industry would reduce purchases of corn by approximately 221 million bushels between 2021 and 2024, leading to more than $1 billion in lost sales revenues for farmers.

Advertisement

Advertisement

•A return to the summertime prohibition on E15 sales also would cause greenhouse gas emissions from gasoline consumption to increase by 2.3 million metric tons of carbon dioxide equivalent between 2021 and 2024. That is an amount equal to the annual GHG emissions from nearly 500,000 cars.

•Potential economic losses over the longer term (2025-2030) would be substantially larger, as it was generally expected that E15 expansion would continue to accelerate and E15 could fully, or mostly, replace E10 as “standard gasoline” by the end of the decade.

“RFA fought tooth-and-nail for nearly a decade to secure the approval for year-round E15 sales in conventional gasoline markets,” RFA President and CEO Geoff Cooper said. “When EPA finally changed its regulations in 2019 to allow uninterrupted sales of E15, the marketplace immediately reacted and retailers across the country started taking steps to offer this lower-cost, lower-carbon fuel to consumers. Now, one misguided court decision threatens to strand billions of dollars in public and private investment, reverse the progress we’ve made on E15, and foreclose on one of our industry’s largest future growth opportunities. As this new report demonstrates, the potential cost of losing that growth opportunity is enormous—and that’s why we can’t let it happen. RFA will continue to pursue all options to ensure retailers have the ability to sell E15 year-round to customers who are demanding cleaner, greener, and more affordable fuel options.”

Related Stories

Bangkok Airways Public Company Limited has officially announced the adoption of sustainable aviation fuel (SAF) on its commercial flights, reinforcing Thailand’s green aviation industry. The initiative took effect starting July 1, 2025.

Avalon Energy Group LLC and Sulzer Chemtech have signed a strategic alliance and partnership agreement to scale up the production of SAF. Under the agreement, Avalon has selected BioFlux technology for its portfolio of SAF projects.

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

Upcoming Events