Tap, Enhance, Process Stream to Create Value-added Products

April 15, 2013

BY Dil Vashi

Many ethanol producers look for additional revenue streams beyond the core ethanol and distillers grains to extract corn oil and capture CO2. Opportunities exist to expand that even further, integrating available synergies from the underutilized carbon dioxide resource as well as other waste streams.

The potential for CO2 to serve as an additional revenue stream is well-known. Unlike CO2 from coal-fired power plants, carbon dioxide produced in the ethanol process is regarded as pure, with a CO2 concentration of up to 99 percent. After some minor processing to remove the small amounts of impurities, the pure CO2 stream can be sold to the merchant markets for use in beverage production and certain medical uses, as well as dry ice. Ethanol-based CO2 now makes up nearly one-third of the North American supply of CO2.

A typical ethanol plant producing 50 MMgy will also produce roughly 150,000 metric tons of CO2 per year. As large as this number is, the price of raw gas sold does not add enough revenue to offset the losses ethanol plants are suffering in today’s tight margin environment. Ethanol producers typically sell the raw CO2 to refining companies that then sell the refined CO2 to the merchant markets. In addition to the beverage, medical and dry ice markets, CO2 is also used in heavy industrial processes such as enhanced oil recovery and fracturing, which are both techniques for the recovery of oil from older oil wells.

The value of the refined CO2 from the merchant and industrial markets does not accrue to the ethanol producer but, rather, to the refined CO2 supplier. Ethanol producers cannot justify the large capital expense required to refine and market the refined CO2, and are thus not deriving the full value of their production.

Tapping Process Streams

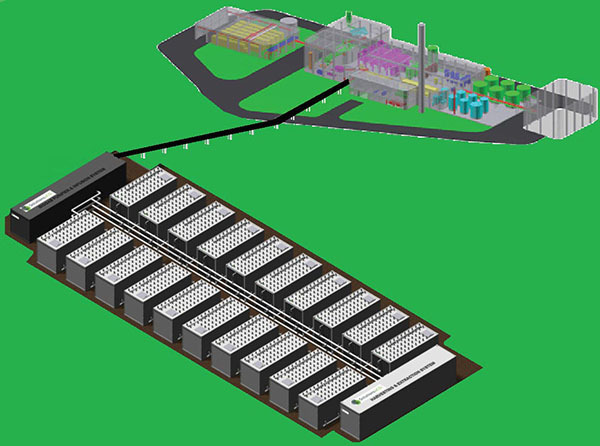

The CO2, as well as the stillage, can also be utilized in the production of high-value coproducts for needed revenue generation. Stillage has little economic value and is thus recycled to the maximum extent possible or simply disposed of. An entirely new use for such process streams can deliver returns to producers and, we would argue, is required to offset losses in today’s tight margin environment for ethanol producers. Our company, Solutions4CO2 Inc., is proposing a solution to utilize both stillage and undervalued CO2 in its trademarked Integrated Biogas Refinery to produce new coproducts, algae biomass and oil, for sale in high-value nutraceutical and pharmaceutical markets.

Advertisement

The IBR takes organic waste such as stillage and produces biogas through anaerobic digestion (AD). North America, with about 200 installed AD facilities, lags behinds Europe where 8,000 AD units have been installed over the past 10 years. With tough regulations regarding waste-handling stimulating AD development and long-term subsidized power purchase agreements incenting renewable power, that number is expected to grow to more than 25,000 by 2020. Lacking those incentives, the North American utilization of AD requires improving the payback periods and addressing air and water permitting issues. Meeting tight air quality regulations surrounding hydrogen sulfide (H2S) emissions is a particular challenge. The presence of corrosive H2S in the AD biogas also adds to the maintenance cost of the gensets used to process the biogas stream into power.

Solutions4CO2 has developed a trademarked Biogas Purifier and Infusion System to address those issues. AD biogas, containing roughly 60 percent methane, 39 percent CO2 and small amounts of hydrogen sulfide (H2S), is processed in the BPIS using a patented microporous, hollow-fiber technology to separate the CO2 and H2S and infuse them into water. The BPIS removes more than 85 percent of the CO2 and 95 percent of H2S from the biogas stream and delivers a 90 percent purified methane stream to a genset for more efficient power production. The BPIS can also capture and infuse the CO2 directly from the ethanol process stream if an AD is not desired.

The CO2/H2S, or CO2-only infused water is then used to cultivate microalgae in an algae cultivation system—the source of extractable high-value oils containing nutraceutical and pharmaceutical coproducts such as omega-3 and astaxanthin.

The IBR is a closed loop system that utilizes all of the outputs of the AD system as inputs to the coproduct platform. Power, CO2, H2S, clean methane, water and digestate from the AD are utilized as inputs to the coproduct platform.

Advertisement

Accruing Additional Value

Ethanol plants require large capital outlays up to $200 million for 100 MMgy of capacity. The current losses can be more than offset with a relatively low, additional capital outlay for an IBR. For a marginal investment, the ethanol plant can install the IBR and process the stillage and CO2 byproducts on site and earn the value added from the utilization of the waste streams in the production of high value added coproducts. Instead of merely selling the CO2 to the markets described above, the utilization of the waste streams on-site and ownership of the IBR allows the plant to accrue the value creation and strengthen its overall financial profile.

The operation has now been transformed from an ethanol plant producing ethanol with a CO2 byproduct to an Integrated Biogas Refinery producing high-value algae-based products utilizing CO2 and power from the stillage from corn, with the ethanol being the byproduct. This Integrated Biogas Refinery model allows for ethanol production to continue sustainably and profitably, while also reducing CO2 emissions and making valuable use of all the products in the value chain including the production of high-value nutraceutical and pharmaceutical coproducts. The low capital and operating expenditure of the IBR and high-margin value of the coproducts results in payback periods under three years.

Solutions such as the IBR are an example of how the model of integrating various technologies that have a common denominator, such as CO2, can transform struggling industries into sustainable industries by looking at the total product of a process and utilizing each product for its most value-added use. The key is enabling the producers of these byproducts to earn their full value instead of simply selling them as commodities.

In addition to the ethanol industry, a number of other sectors are suited to IBR deployment utilizing AD biogas from dairy waste or commercial/municipal organic waste. Solutions4CO2 currently has its commercial demonstration facility in New Brunswick, Canada, which is producing microalgae using infused CO2 from AD biogas on a dairy farm.

Author:

Dil Vashi

Manager, Corporate Development, S4CO2

416-859-0909

dil.vashi@s4co2.com

The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

Upcoming Events