The Andersons expects improved ethanol performance in Q4

November 4, 2021

BY Erin Krueger

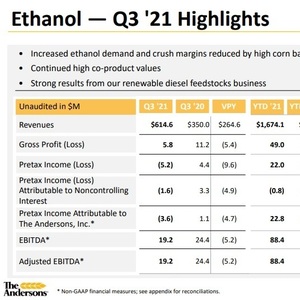

The Andersons Inc. released third quarter financial results on Nov. 2, reporting a loss for the company’s ethanol segment. The company expects to report improved results in the fourth quarter, as strong ethanol margins are expected for the three-month period.

The Andersons’ ethanol segment reported a pretax loss attributable to the company of $3.6 million for the third quarter, compared to pretax income attributable to the company of $1.1 million reported for the same period of last year.

The company said the decline was driven by higher corn basis at all five ethanol plants eroding any board crush margins. Partially offsetting the ethanol margin decline was increased high-protein feed values and continuing corn oil strength.

Advertisement

Advertisement

According to The Andersons’ profitable third-quarter trading of ethanol, feed ingredients and vegetable oil exceeded last year’s third quarter. Stocks of ethanol are at very low levels, the company said, leading to ethanol board crush margins that are positive into the first quarter and despite a projected seasonal slowdown in gasoline demand. Industry production increases are expected in response.

Sales volume for ethanol, corn oil and feed ingredients were up during the third quarter, driven by higher production and additional third-party sales from the trading business, according to The Andersons. Hedges on forward ethanol production are in place for a portion of expected production, the company added.

"Ethanol margins have strengthened through the fall maintenance season and U.S. stocks are low at this time,” said Pat Bowe, president and CEO of The Andersons. “We are focused on risk management and effective hedging and continue to see strong returns from co-products, particularly distillers' corn oil," added Bowe. "We anticipate strong fourth quarter margins in ethanol.”

During a third quarter earnings call held Oct. 3, Bowe explained that new renewable diesel demand is continuing to drive high corn oil values. “Biofuels is a rapidly evolving space, especially in supply chain surrounding renewable diesel,” he said.

Advertisement

Advertisement

Bowe also noted that The Andersons recently received approval of its California Air Resources Board application for ethanol sales from its plant in Colwich, Kansas. Once verified, the said the company expects to begin shipments to California later this year.

Overall, The Andersons reported net income attributable to the company of $13.9 million for the third quarter, compared to a $1.5 million loss reported for the same period of last year. Adjusted net income was $5.2 million, compared to a $2.9 million loss. Diluted earnings per share were at 41 cents, up from a 4 cent loss. Adjusted diluted earnings per share reached 15 cents, up from an 8 cent loss reported for the third quarter of 2020. EBITDA was $67.9 million, up from $42.9 million, with adjusted EBITDA at $56.3 million, up from $47 million.

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

Upcoming Events