The Importance of Feedstock Within California's LCFS

May 1, 2013

BY Graham Noyes

California’s Global Warning Solutions Act of 2006 (AB 32) established the state’s goal of reducing its greenhouse gas (GHG) emissions to 1990 levels by 2020. The statute charged the California Air Resources Board with developing and implementing regulations in multiple sectors to achieve that goal. In January 2007, then Gov. Arnold Schwarzenegger issued Executive Order S-01-07 calling on CARB to determine whether a low carbon fuel standard (LCFS) could be adopted under AB 32 to reduce the carbon intensity of California’s transportation fuels by at least 10 percent by 2020.

In April 2010, CARB adopted a final set of regulations that is now codified at Cal. Code Regs. tit. 17, §§ 95,480-95,490. The LCFS applies to transportation fuels that are “sold, supplied, or offered for sale in California” and “any person who as a regulated party…is responsible for a transportation fuel in a calendar year.” The LCFS applies to a wide range of transportation fuels and technologies including liquid and gaseous fuels such as biodiesel, hydrogen and biomethane. While somewhat comparable to the federal renewable fuel standard (RFS), there are significant variations between the programs.

Advertisement

The LCFS reduces GHG emissions by regulating the full life-cycle carbon intensity (CI) of transportation fuels used in California. The CI score of a fuel reflects not only GHG emissions created at the time of combustion, but also the GHG emissions associated with its extraction and refining, its transport to California, and any indirect land use change (ILUC) attributed to the feedstock based on GHG land use modeling. Regulated parties (petroleum refiners and importers) must meet an annual standard for CI, which decreases more rapidly in the later years of the program. The increasingly difficult CI requirements and the ability to bank credits drive value for biodiesel producers who supply low CI biodiesel into California. California CI credits may be generated in addition to RINs under the federal renewable fuel standard and create two revenue streams for qualified biodiesel.

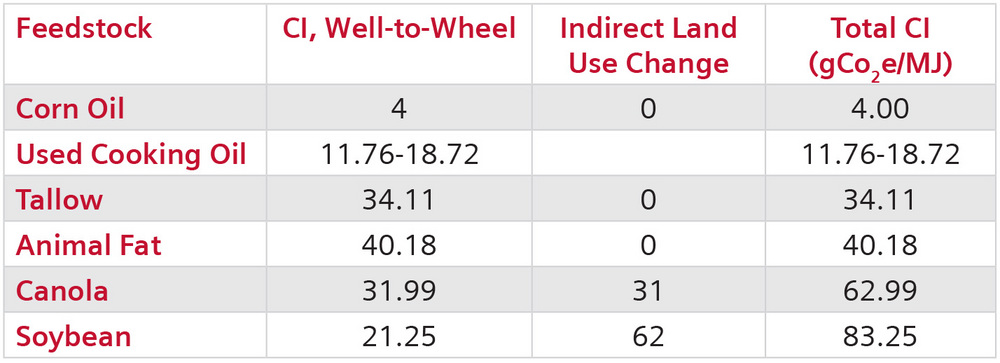

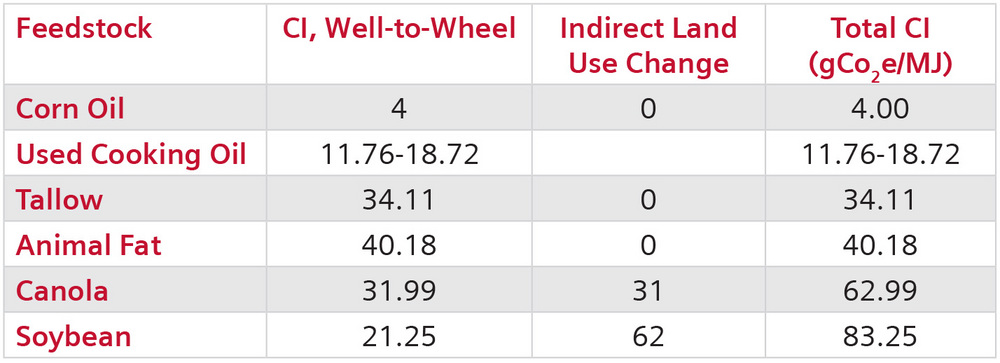

For biodiesel producers, feedstock is the controlling factor of the CI score as it heavily influences the biodiesel’s total GHG emissions. The following table illustrates the wide range of CI scores for biodiesel fuels produced from various feedstocks.

To calculate the value of the LCFS credit that the biodiesel will generate, it is necessary to first determine the GHG reduction that the biodiesel provides as compared to the annual diesel fuel CI score that the regulated parties must achieve. For 2013, that required overall CI score is 93.76. Compared to this requirement, soy biodiesel delivers a modest reduction of approximately 10 grams of carbon dioxide equivalent emissions per mega joule of energy. By contrast, used cooking oil (UCO) provides closer to an 80 gCO2e/MJ reduction and therefore generates about eight times as many CI credits for the regulated parties.

Advertisement

Using an approximate rule of thumb, each 10g of reduction is worth about 1.25 cents per gallon when the carbon market price is $10 per ton. UCO would provide 10 cents per gallon. The recent market range has been in the $30 to $40 per ton resulting in soy generating a value of 4 to 5 cents per gallon and UCO biodiesel providing a 30- to 40-cent credit for the producer. Mixed feedstock producers must follow CARB requirements to account for their blends on a batch basis and cannot apportion the batch so that all the low CI gallons go to California and all the other gallons go to other states.

Notably, soy’s CI score is considerably worse than canola due to the attribution of twice as much ILUC impact to soy as to canola. CARB staff is currently working on reviewing the soy and canola modeling and expects to revise the soy CI score by November, which may result in improved credit opportunity for soy producers.

Author: Graham Noyes

Attorney, Stoel Rives LLP

206-386-7615

jgnoyes@stoel.com

Related Stories

While final IRS guidance is still pending, the foundation of the 45Z program is well defined. Clean fuel producers should no longer be waiting; they can now move forward with critical planning and preparation, according to EcoEngineers.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

The U.S. Senate on July 23 voted 48 to 47 to confirm the appointment of Aaron Szabo to serve as assistant administrator of the U.S. EPA’s Office of Air and Radiation. Biofuel groups are congratulating him on his appointment.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

Upcoming Events