The New World of Biodiesel Feedstocks

May 1, 2013

BY Nate Burk

The biodiesel industry is booming and currently there are no signs of it slowing down. Through efforts put forward by the National Biodiesel Board and biodiesel producers, the U.S. is on tap to produce the largest volume of biodiesel gallons in 2013 than any other year. Last year the renewable fuel standard (RFS2) mandate called for 1 billion gallons to be blended, which was a 20 percent increase over the prior year. EMTS data reported 1.143 billion gallons were actually blended, which is 14.3 percent more than RFS2 called for. This year the current RFS2 mandate sits at 1.28 billion gallons, a 28 percent increase over last year’s mandate and a 10.7 percent increase over last years blended gallons.

Nonetheless, all signs point to 2013 being the largest production year in biodiesel that we have ever seen. So what does this mean for feedstock prices?

The commodity complex has become much more volatile in the past 10 years than ever before. Keep in mind this is the time frame in which the biodiesel industry was “born and raised.” We have observed a paradigm shift in pricing for not only the exchange-traded commodities, but also in the nonexchange-traded commodities, which include the majority of biodiesel feedstocks. These price swings have become significant and added complexity to the profitability/sustainability of many biodiesel plants. What does this exactly mean, and how can one manage the price swings?

Advertisement

Advertisement

Let’s begin with the largest feedstock consumed by the biodiesel industry, which happens to be exchange-traded as well: soybean oil. With very few exceptions, soybean oil had traded in a 20-cent range between 1975 through 2006 (15 to 35 cents/lb). In 2007, soybean oil rallied 20 cents and closed just below the 50-cent mark. It then rallied yet another 20 cents in just the first three months of 2008. Many traders were asking themselves just how much higher this market could go; but then the second half of 2008 rolled around. Soybean oil gave up over 35 cents/lb in just the latter half of 2008. Within the next two years (2009-‘10), soybean oil had regained 30 cents/lb of these losses. Why the extreme shift in volatility?

Many tie the growth in Asia, specifically China, increased speculation in futures and options trading on commodities, and the increased production of biofuels to the recent rise in volatility. Let’s concentrate on the rise in biofuels, and more specifically diesel, over the past eight years. Since 2005, we have increased biomass-based diesel production by more than 18-fold in the U.S. We now have plants online that could singlehandedly match 2005’s total annual production of 60 million gallons in less than six months. Another way to look at it is that we have added 8.5 billion pounds of demand to the vegetable oil, fats and grease markets in the U.S. This represents more than 29 percent of the total U.S. production of soybean oil, fats and greases today. Throwing all other market drivers out of the equation, the simple addition of this demand pull from the biodiesel industry has helped give push to a paradigm shift in vegetable oil, fats and grease prices.

Prior to the inception of biodiesel, fats and greases were viewed as more of a byproduct than anything, and more often than not were a cost center to companies that produced these products. It was not that long ago when restaurants actually paid to have their used cooking oil (UCO) picked up and “disposed” of. Now these restaurants have competition from aggregators to not only collect their UCO, but also to get paid for the collection. The same thing is happening in the fats market. One of the clients I trade with recalls when he purchased 100 trucks of poultry fat for 4 cents/lb back in 2004.

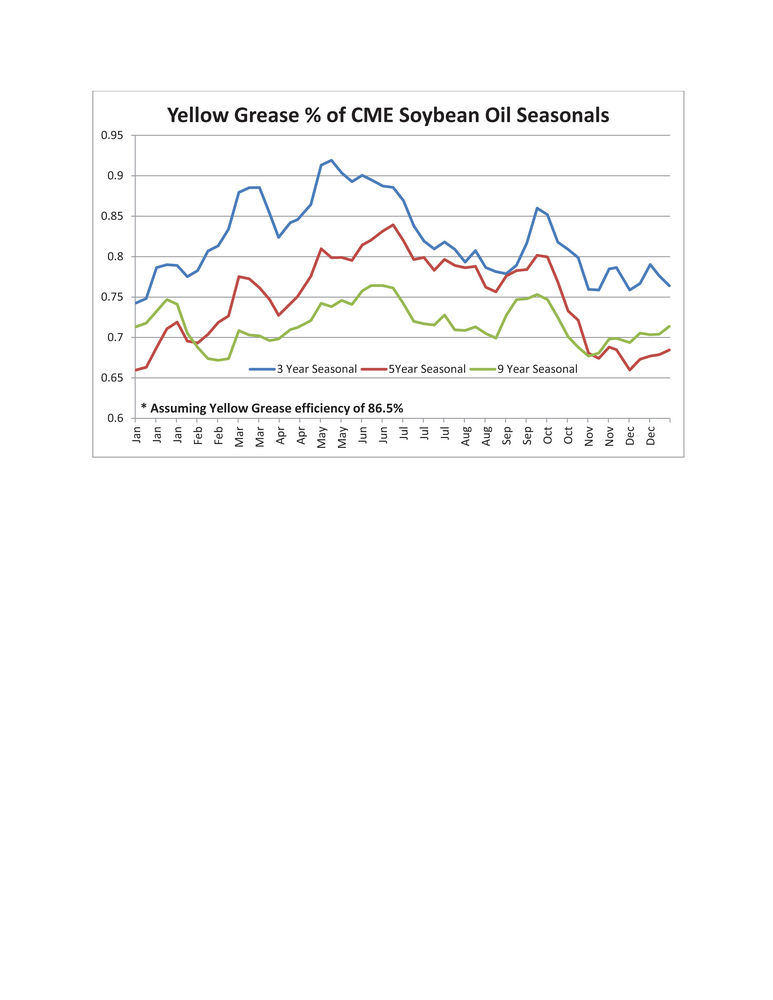

This is equivalent to, if not less than, the cost it would have taken to produce/render this fat. Those days are over now, and these products have been labeled “liquid gold” by many in the industry. With the inception of biodiesel, these products are now substitutes for vegetable oils in the production of biodiesel. In the early days of biodiesel, the technology for the most part only allowed for vegetable oils to be processed into biodiesel. Now second-generation technologies allow for plants to have the capability to produce 100 percent of their volume out of fats and greases. That said, fats and grease prices have begun to narrow the discount they trade to soybean oil and it becomes a game of efficiencies. For instance, soybean oil at 50 cents/lb with a 7.35 lbs/gallon efficiency = $3.675/gallon.

Advertisement

Advertisement

If this same plant assumes an efficiency of 8.1 lbs/gallon for UCO, then they could back into what they could pay on an equivalent for soybean oil by taking $3.675/8.1 = 45 cents/lb. That said, some plants also have to take into account other efficiencies such as reduced run rates, discounts on the finished feedstock and additional catalyst needed to react the material. Once a plant can understand what these other efficiencies are on a per-gallon basis, it can simply subtract this number from the 45 cents/lb. This then lets a plant know what a better buy is. Let’s assume a plant calculated its other costs of efficiencies at 3 cents/lb when running UCO as compared to soybean oil. This would tell the plant anytime they can buy UCO at 42 cents/lb or better that running UCO is more profitable than running 50 cent/lb soybean oil.

As mentioned above, fats and greases have begun to follow the price fluctuation of the soybean oil market closer than ever before. So where are prices going? This question highly revolves around the production of the soybean crop, and further, how many soybeans will be crushed for the production of soybean meal and soybean oil. Prices in the coming year will be highly dependent on the current growing season. We are coming off a very tight supply-and-demand table for soybeans and are projected to plant one of the largest crops to help replenish stocks. With a normal growing season we could see soybeans and soybean product prices fall considerably, which leads fats and greases. If the weather does not cooperate and production of soybeans comes in below current expectations, we could see prices hold, if not rise.

The demand for soybean oil also plays an important role in the prices for biodiesel feedstock. Soybean oil going into biodiesel now makes up just shy of 25 percent of the total soybean oil demand. It is interesting to note that the RFS2 calls for a 28 percent increase in biomass-based biodiesel while the USDA is only calling for less than a 1 percent increase in biodiesel demand for soybean oil between the 2011-‘12 and 2012-‘13 crop years (soybean oil crop year runs from October to September of the following year). It is much more complicated to produce more fats and greases, therefore the increased demand for biodiesel feedstocks in the coming years will most likely have to be met with vegetable oils.

Author: Nate Burk

Risk Management Consultant, FCStone LLC

800-422-3087 ext. 17419

Nate.burk@intlfcstone.com

Related Stories

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Total U.S. operable biofuels production capacity expanded in May, with gains for renewable diesel and a small decrease for ethanol, according to data released by the U.S. Energy Information Administration. Feedstock consumption was up.

The U.S Department of Energy Bioenergy Technologies Office, in partnership with the Algae Foundation and NREL, on July 21 announced the grand champion and top four winning teams of the 2023 - 2025 U.S. DOE AlgaePrize Competition.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

Upcoming Events