The Road to Renewable Fuel Readiness Runs Through Feedstock Integrity

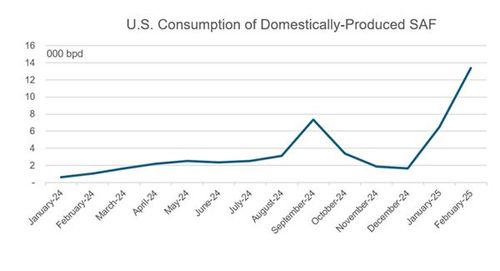

Figure 1: U.S. Consumption of Domestically Produced SAF. SOURCE: U.S. EPA, ECOENGINEERS

May 22, 2025

BY David Dix

As global efforts to decarbonize aviation and ground transport accelerate, the urgency to grow the hydroprocessed esters and fatty acid (HEFA)-based renewable diesel (RD) and sustainable aviation fuel (SAF) business has never been greater. Yet, for producers and developers of such projects, one of the biggest barriers to growth isn’t infrastructure—it’s sourcing consistent, traceable feedstock and complying with complex and evolving regulations.

Despite these challenges, demand for SAF in the U.S. continues to climb. The market’s momentum underscores a growing urgency to overcome feedstock and compliance challenges. In February 2025, U.S. domestic demand for SAF was five times higher than the average monthly demand in 2024, as reflected in the U.S. Environmental Protection Agency’s D4 renewable identification number (RIN) generation data. (Figure 1)

This surge in demand reflects more than just market enthusiasm—it signals a critical juncture for SAF and RD developers. As the industry scales, the ability to align innovative project concepts with the realities of feedstock availability and regulatory expectations becomes a defining factor in long-term viability.

The Feedstock Challenge

To reach a final investment decision, SAF and RD project developers need long-term feedstock security. However, this is often complicated by geography. SAF and RD feedstocks such as used cooking oil (UCO), tallow, soybean oil and canola are often not produced in the same regions where the finished fuels are consumed. For example, UCO is often collected in densely populated urban centers or imported from Asia, whereas SAF production and consumption are frequently concentrated near airports or coastal hubs. This disconnect raises costs and increases lifecycle carbon intensity (CI), which can make it difficult to participate in credit programs like California’s Low Carbon Fuel Standard and similar state and provincial programs.

Technology flexibility adds another layer of investment costs. While most SAF-capable facilities can also produce RD, the reverse is often the case, requiring additional processing infrastructure. As SAF demand grows due to airline decarbonization targets and environmental, sustainability and governance reporting, production flexibility—the ability to switch between RD and SAF—is becoming a strategic advantage for developers. However, adding SAF capacity to an existing RD facility adds capital expenditure and operational expenditure.

Traceability and Compliance Risks

As feedstock values rise, so does the risk of fraud. For example, regulatory programs in the European Union and United Kingdom restrict or cap many virgin oil feedstocks and create an incentive for UCO fraud in major UCO exporting countries. In some cases, suppliers may fry a single item in virgin oil and falsely label it as UCO to qualify for compliance programs. This not only undermines compliance integrity and increases scrutiny from regulators, but it also disincentivizes the proper end-of-life treatment of materials, as economic pressure favors labeling waste streams as renewable feedstocks, regardless of origin. Feedstock traceability tools that include detailed documentation of origin, transportation and chemical analysis are now critical for maintaining regulatory alignment across jurisdictions.

Recent cases underscore the risk. In Norway, for example, retroactive credit callbacks were issued when imported tallow failed to meet compliance standards. These events signal the growing need for robust chain-of-custody systems and strict supplier verification.

Advertisement

Aligning Facility Design with Feedstock Geography

Regional advantages must drive feedstock decisions. Tallow is abundant in cattle-producing regions like Texas, Montana and Brazil. UCO thrives in countries with high rates of deep-frying, particularly across Asia. Woody biomass and agricultural residues are prevalent in the Pacific Northwest and southeastern U.S. Eschewing regional logic in favor of convenience often leads to high CI scores and lower credit values.

Furthermore, transportation emissions, energy inputs and process efficiency can impact the CI score of the fuel. Therefore, facility siting decisions should also reflect access to both feedstock and low-carbon energy inputs.

Timing is Everything

In one recent case, a production facility was built and feedstock secured, only for the company to realize that EPA pathway approval would take nine months to a year to complete. Early engagement with federal and state regulators, as well as third-party advisors with regulatory and compliance expertise, is essential to run in parallel to engineering, procurement and front-end planning stages. This approach sets investors and stakeholders on a path to realizing long-term value creation for their RD and SAF investment.

It is also important for SAF and RD developers to work backward from their targeted start date, identifying milestones for life-cycle assessment modeling, feedstock validation and tax credit registration and compliance.

US, EU Policy Picture

Meanwhile, policy uncertainty continues to hamper progress. In the U.S., SAF and RD producers are awaiting further guidance on the Section 45Z Clean Fuel Production Tax Credit under the Inflation Reduction Act. Without it, revenue modeling and investment decisions remain speculative. Meanwhile, the expiration of the Section 40B tax credit and uncertainty surrounding the import treatment of feedstocks, such as tallow, further complicate the market.

In the EU, mandates under ReFuelEU Aviation, part of the “Fit for 55” package, require increasing volumes of SAF in aviation fuel starting in 2025, with targets rising steadily to 2050. It is worth noting that in the EU, the amount of UCO feedstock that can contribute to the Renewable Energy Directive is capped at 1.7% in the road transport sector, but it is not capped in aviation fuel mandates. Meanwhile, maritime programs, such as the FuelEU Maritime Regulation, are expected to drive RD demand, but feedstock competition and infrastructure gaps remain. Globally, a unified SAF credit and traceability system is lacking, forcing producers and airlines to juggle multiple compliance frameworks with differing definitions and requirements.

Advertisement

Best Practices to Mitigate Feedstock Risk

To navigate these challenges, producers should:

1. Secure long-term feedstock and offtake agreements that align with financing and regulatory requirements and consequences.

2. Document traceability thoroughly, from origin to final use, using bills of lading, testing data and compliance certifications.

3. Engage early with regulators and compliance experts to understand the timing and requirements for fuel pathway approvals and tax credit eligibility.

4. Align feedstock selection with regional supply advantages to minimize life-cycle emissions and cost.

5. Design facilities with flexibility in mind to adjust to future shifts in demand and policy.

Looking Ahead

The renewable fuel sector is at an inflection point. As SAF and RD projects develop, their long-term success depends on feedstock integrity, traceability and regulatory foresight. Clarity on tax credits, global policy harmonization and smarter infrastructure decisions are critical to reducing both operational and capital risk. Developers who treat compliance and traceability not as regulatory hurdles, but rather as strategic investments from the outset, will be best positioned to deliver the low-carbon fuels the world urgently needs.

Author: David Dix

Account Manager, Low-Carbon Petroleum

SAF, Renewable Diesel and Carbon Markets

EcoEngineers

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events