UFOP: Planned antisubsidy duties on palm biodiesel ineffective

August 9, 2019

BY UFOP

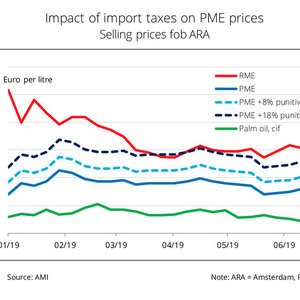

The preliminary antisubsidy duties announced by the EU Commission will not reduce imports of palm oil-based biodiesel. This is the conclusion the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has drawn from a comparison of 8 and 18 percent duty increases.

In the antisubsidy proceedings against Indonesia, the responsible committee of the EU Commission agreed at the end of July to impose preliminary punitive tariffs. These tariffs will be between 8 and 18 percent and will presumably come into force on Sept. 5. The reason given for this step was that the Indonesian government supports biodiesel exports by providing tax breaks and low-priced palm oil. The tariff increases are intended to offset competitive disadvantages for the European biodiesel industry.

UFOP has pointed out that the scheduled punitive tariffs will not raise the price for palm oil methyl ester (PME) to the price level of rapeseed oil methyl ester (RME). In other words, European rapeseed production, as a feedstock source for biodiesel production, will not benefit from the step taken. UFOP does not agree with the low level of the punitive tariffs. The association argues that just in the past weeks the EU Commission itself has taken a very critical stance on the issue of indirect changes in land use in connection with European biofuels policy.

Advertisement

Advertisement

The revision of the Renewable Energy Directive (RED II) provides that palm oil-based biofuels must be reduced as from 2024, until which year the levels consumed in 2019 will serve as the maximum value, to be scaled down to zero by 2030. UFOP contends that the EU Commission's hesitation to impose efficient punitive tariffs prevents the tariffs from having a reducing effect on consumption in the European Union in 2019. Because of this, the association has called on the EU Commission to impose higher and more efficient punitive tariffs in order to make a perceptible contribution towards avoiding negative impacts on land use in Indonesia.

Advertisement

Advertisement

Related Stories

At the University of Missouri, plant biochemist Jay Thelen is using arabidopsis as a powerful model to explore ways to boost oil production — an important step toward creating more sustainable, plant-based energy sources.

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Klobuchar, Moran introduce bipartisan legislation to support biorefineries, renewable chemicals, and biomanufacturing

Sens. Amy Klobuchar, D-Minn., and Jerry Moran, R-Kan., on July 31 announced the introduction of the Ag BIO Act. The legislation aims to update the USDA’s loan guarantee program to better support biorefining projects.

U.S. Secretary of Agriculture Brooke L. Rollins on Aug. 1 announced the opening of a 30-day public comment period for stakeholders to provide feedback on the department’s reorganization plan, as outlined in the memorandum released July 24.

Sen. Chuck Grassley, R-Iowa, on July 31 pressed Derek Theurer, President Donald Trump’s nominee to serve as under secretary of the U.S. Department of Treasury, on the expected timeline for the release of 45Z guidance.

Upcoming Events