Understanding CIP Additive Packages for Ethanol Production

PHOTO: STOCK

September 22, 2021

BY Lance Renfrow

The history of proper clean-in-place (CIP) cleaning predates modern fuel ethanol production, dating back to the late 1960s. In its early days, CIP was primarily used in the food and beverage industry, which for years used strong acids and alkali products for cleaning. Caustic soda was, and often still is, the product of choice because of its excellent organic dissolving and saponification powers. Over the years, compounders formulated a wide variety of cleaning compounds, with the result being commercially available concentrated cleaners. Today, many people are unaware of how the additives are used, which is relevant to understanding how they function.

The base of many cleaning solutions is caustic soda. Typically, the concentration of a CIP cleaner is 90% caustic soda that is 50% “active” sodium hydroxide. The remaining 10% is often a mixture of other chemical components.

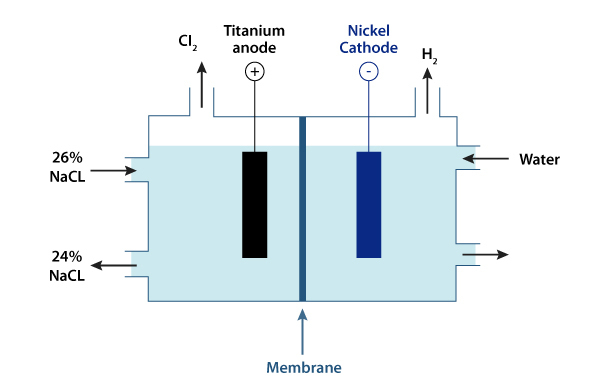

The current U.S. market for liquid caustic soda is approximately 11 million short dry tons, with a world market of approximately 43 million short dry tons. The market is generally sold on a dry ton basis and is generally billed on the active NaOH content. Most formulators, distributors, or manufacturers, when blending, will sell product on an “as is” pound basis or by the gallon. Some plants will use high-purity (membrane-grade) material because the chloride content of the lower grades of caustic soda has a long-term detrimental effect on stainless steel.

Accurate blending of caustic soda is also important as the density and content of caustic soda changes at a non-linear relationship.

Formulating CIP Solutions

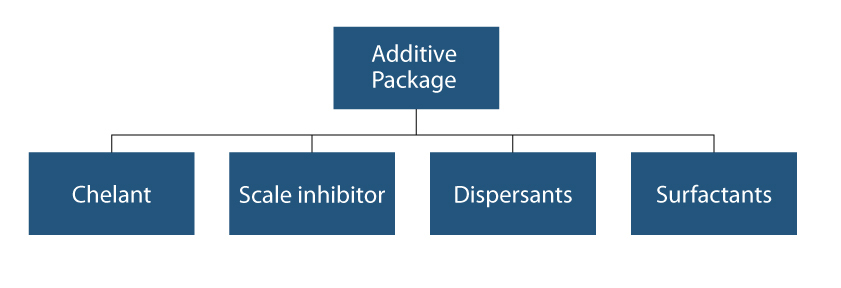

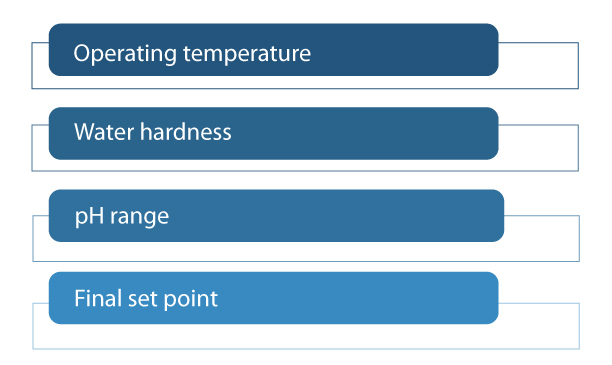

Clear Solutions USA and some other companies blend what is called an “additive package” into caustic soda to create more effective and efficient CIP solutions. These additive packages often consist of a chelant, a scale inhibitor, a dispersant and a surfactant. Some ingredients can be multifunctional. The formulation should vary from plant to plant because the effectiveness of this package depends on operating conditions of temperature, water hardness, pH range and, lastly, the final percentage of the working solution or the “set point.”

The operating temperature should be known because certain chemical components are affected by the temperature and may not clean as well in high or low temperatures. The water hardness is also important because different amounts of chelating agents and scale inhibitors should be added depending on how high the water hardness is. The seasonal variances of the water hardness should also be noted, and the maximum value should be considered in formulating to maximize cleaning efficiency. The pH range determines the type of chelation package. The final set point should also be known because it determines the final concentration of caustic soda and the additive package.

Once the operating conditions are known, the proper additive package can be determined.

Additive Package Components

Chelating Agent: The word chelant is from the Latin word chela meaning “claw.” Chelants are materials that work in aqueous solutions to tie up metal ions so they are no longer effective. The term “chelating agent” refers to a molecule that contains two or more complexing sites or claws capable of coordinating around a metal ion. In technical terms, chelation is a kind of sequestration process whereby the chelating agent forms a nonionic ring structure with a di polyvalent cation by ionic valence bonding.

Chelation is important because the chelating agents tie up the metal ions in hard water and inhibit their ability to interact with the other cleaning agents. The concentration of chelating agents needed is directly related to the water hardness. The harder the water, the higher the concentration required. When formulating an additive package, it is important to note the water hardness as well as the fluctuation of the water hardness in the plant.

Scale Inhibitor: Scale is defined as deposit adhering to a surface. The scale inhibitor virtually modifies and attacks the crystal growth by changing the structure and prevents the scale from forming. In ethanol plants, scale can be formed with the presence of calcium, magnesium, iron, and other trace minerals. The most commonly formed scale is calcium carbonate, followed by calcium oxalate (beerstone).

Dispersants: Dispersants attack the undesired species by using a high negative charge. This works much like two magnets with like charges (the magnets repel one another). The charge of the dispersants causes the contaminants to be more suspended within the solution, which allows for easier washing.

Surfactant: The real breakthrough in CIP formulations was the addition of surfactants. Surfactants effectively lower the surface tension of a given solution. The decrease in surface tension allows for easier wetting of a surface as well as easier rinsing. This increase in wetting allows for less product use because the low surface tension allows for more spreading across a given surface as well as easy removal with a water rinse. Together, this also amounts to a decrease in cleaning time because the product is able to spread across the surface quickly as well as rinse easily.

When first introduced, surfactants led to large amounts of foaming during the cleaning cycle. Over time, new low-foaming surfactants were developed and have eliminated the foam problem.

The use of surfactants has been limited over the years due to caustic soda’s high concentration (50%). The high concentration of caustic soda limits the ability of surfactants to couple and causes the product to have difficulty going into solution.

Clear Solutions has successfully trialed its CIP additive package at several ethanol plants in Indiana, Michigan, and Minnesota. These plants are currently using our formulations, which are patented and patent-pending. Producers using the package are realizing reduced caustic usage by 25 percent; elimination of calcium carbonate and calcium oxalate, reduced or eliminated hydroblasting of the evaporators; reduced amount of time needed to clean evaporators and other heavily soiled equipment; higher flow rates without additional steam, faster cleaning and reduced utilities (gas, electricity, water, and wastewater treatment) costs. The reduced time to clean has resulted in increased overall production and allowed for more time and resources for cleaning difficult equipment.

Author: Lance Renfrow

President & Founder

Clear Solutions USA LLC

480-539-4276

lance@clearsolutionsusa.com

The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Advertisement

Advertisement

Related Stories

FutureFuel idles biodiesel production amidst regulatory uncertainty, shifts full focus to specialty chemicals growth

FutureFuel Corp. on June 17 announced it will temporarily idle its biodiesel facility upon completion of its remaining contractual obligations, anticipated to occur by the end of June. The company is shifting its focus to specialty chemicals.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

TotalEnergies has announced the company expects its facilities will be able to produce more than half a million tons of SAF a year by 2028 to cover the increase in the European SAF blending mandate, set at 6% for 2030.

Total U.S. biofuels production, including ethanol, renewable diesel, biodiesel and other biofuels, including SAF, averaged a record 1.39 million barrels per day last year, according to data released by the U.S. EIA on June 9.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events