US biodiesel industry testifies on illegal trading at ITC hearing

Source: EIA Data Graphically Compiled by Ron Kotrba, Biodiesel Magazine

April 13, 2017

BY The National Biodiesel Board

The U.S. Commerce Department announced April 13 that it is formally initiating antidumping and countervailing duty investigations of biodiesel imports from Argentina and Indonesia. This decision follows a petition that was filed with the U.S. Department of Commerce and the U.S. International Trade Commission on behalf of the National Biodiesel Board Fair Trade Coalition, which is made up of the National Biodiesel Board and U.S. biodiesel producers.

“Initiation of these investigations validates the allegations in our petition, and we look forward to working with the U.S. government agencies during the course of the next year to enforce America’s trade laws," said Anne Steckel, NBB vice president of federal affairs in response to this announcement.

The National Biodiesel Board and U.S. biodiesel producers also provided testimony April 13 to the International Trade Commission, explaining that Argentine and Indonesian companies are violating trade laws by flooding the U.S. market with dumped and subsidized biodiesel, and how those imports are injuring American manufacturers and workers.

Advertisement

“Make no mistake, 2016 should have been a banner year for U.S. biodiesel producers with demand growth, stable feedstock prices, and regulatory certainty that should have led to profitability and reinvestment in their businesses, but unfortunately that didn’t happen,” said Steckel. “Instead, dumped and subsidized biodiesel from Argentina and Indonesia entered the United States in record volumes, capturing greater market share at the expense of U.S. producers. The loss of market share has left the domestic industry with substantial unused capacity and the artificially low prices these imports are sold at leave American biodiesel unable to get a fair return for their product.”

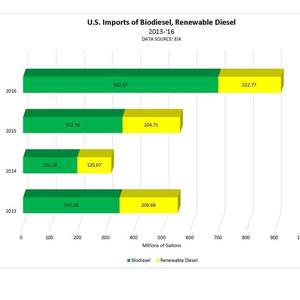

Because of illegal trade activities, biodiesel imports from Argentina and Indonesia surged by 464 percent from 2014 to 2016. That growth has taken 18.3 percentage points of market share from U.S. manufacturers.

“Negative margins within our industry due to low-priced imports have had a major impact on our company, with a disproportionately greater impact on smaller producers,” said Robert Morton, co-founder of Newport Biodiesel, a small biodiesel producer from Rhode Island. “We have halted several plant modification projects as a result of reduced working capital, even for modest projects. Because of this, Newport Biodiesel is being limited in its ability to be a productive U.S. green energy company in what is otherwise a growing market.”

The adverse impact of dumped and subsidized imports is not limited to America’s small biodiesel producers.

Advertisement

“When we see biodiesel from Argentina selling at a discount to the market price of soy oil, the main input into biodiesel, we know we are facing dumped pricing,” said Paul Soanes, CEO and president of Renewable Biofuels (RBF). “The United States is a key market for these exporters, and without a remedy, these unfairly traded imports are likely to continue unabated. That is a further threat to our business.”

According to the Commerce Department’s notice of initiation, there is evidence that dumping margins could be as high as 26.54 percent for Argentina and 28.11 percent for Indonesia. Commerce’s notice of initiation also undertakes to investigate subsidies based on numerous government programs in those countries.

Today’s staff conference is an important step in the administrative process. The commission is expected to make its preliminary decision and vote on May 5. Following that, the next key step will be when the U.S. Department of Commerce announces its preliminary determinations regarding the estimated rates of subsidization and dumping—expected on or about Aug. 22 and Oct. 20, respectively.

The National Biodiesel Board is the U.S. trade association representing the biodiesel and renewable diesel industries, including producers, feedstock suppliers and fuel distributors.

Related Stories

The U.S. EPA on March 12 announced it has kicked off a formal reconsideration of 2009 Endangerment Finding, which forms the legal basis for GHG regulations, and is considering the elimination of the agency’s Greenhouse Gas Reporting Program.

Fuel retailers, trucking fleets and home heating industry urge Congress to extend the biodiesel blenders tax credit

NATSO, representing America’s truck stops and travel centers, SIGMA: America’s Leading Fuel Marketers, and a variety of other groups are urging Congress to extend the “Section 40A" Biodiesel Blenders' Tax Credit.

The U.S. EPA on March 7 announced it will extend the compliance year 2024 Renewable Fuel Standard reporting deadline and signaled its intent to revise the 2024 RFS renewable volume obligation (RVO) for cellulosic biofuel.

The Canada Boarder Services Agency on March 6 announced it is initiating investigations into alleged dumping and subsidizing of renewable diesel from the U.S. The announcement follows complaints filed by Tidewater Renewables Ltd. in 2024.

Lawmakers in both the U.S. House of Representatives and the U.S. Senate on March 6 reintroduced legislation that aims to ensure that RINs generated for renewable fuel used by ocean-going vessels would be eligible for RFS compliance.

Upcoming Events