US biodiesel production, imports strong despite lapsed tax credit

Source: EPA EMTS Data Compiled Graphically by Ron Kotrba, Biodiesel Magazine

March 22, 2017

BY Ron Kotrba

U.S. production and imports of biomass-based diesel remain strong so far early this year despite the lapsed federal biodiesel blenders tax credit and delayed implementation of the 2017 renewable volume obligations (RVOs) under the Renewable Fuel Standard, which were on hold until March 21 as part of the regulatory freeze pending review ordered Jan. 20 by the incoming Trump administration.

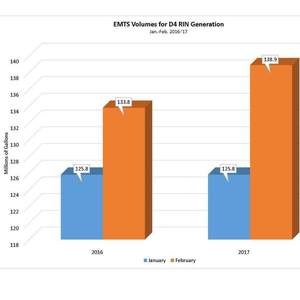

According to U.S. EPA’s EMTS data on RIN generation, volumes of biodiesel and renewable diesel associated with D4 RIN generation for January and February approached 265 million gallons combined, surpassing last year’s figures for the same period when the tax credit was in effect. Of the nearly 265 million gallons, more than 182 million gallons was produced domestically, with more than 82 million gallons of imported product generating D4 RINs in the first two months of this year. Any D6 renewable diesel or biodiesel from palm oil that may have entered the U.S. so far in 2017 would not be included in these EMTS figures, and corroborating import data from the U.S. Energy Information Administration has yet to be published.

Last year, the U.S. imported nearly 693 million gallons of biodiesel and 223 million gallons of renewable diesel, according to EIA data—a record volume totaling more than 915 million gallons of biomass-based diesel. Argentina alone exported 444 million gallons of biodiesel to the U.S. last year, with Indonesia and Canada rounding out the top three supplying nations of U.S. imported biodiesel.

In 2016, U.S. domestic production also hit new heights, with D4-qualified biodiesel and renewable diesel volumes surpassing 1.9 billion gallons, according to EPA’s EMTS data.

Advertisement

Advertisement

This year, while the 60-day regulatory freeze pending review ordered Jan. 20 delayed implementation of the 2017 RVOs for conventional and advanced biofuels and the 2018 RVO of 2.1 billion gallons for biomass-based diesel, the 2017 biomass-based diesel RVO of 2 billion gallons was finalized in late 2015 and, therefore, was not affected by the freeze.

Advertisement

Advertisement

Related Stories

California’s new specified source feedstock attestation requirement: A critical new compliance step for renewable fuel producers

As of July 2025, California’s SCFS requires renewable fuel producers using specified source feedstocks to secure attestation letters reaching back to the point of origin. This marks a significant shift in compliance expectations.

The public comment period on the U.S. EPA’s proposed rule to set 2026 and 2027 RFS RVOs and revise RFS regulations closed Aug. 8. Biofuel groups have largely expressed support for the proposal but also outlined several ways to improve the rulemaking.

The U.S. renewable fuels industry on Aug. 8 celebrated the 20th anniversary of the Renewable Fuel Standard. Federal lawmakers also marked the occasion with resolutions introduced in the House and Senate earlier this month.

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Klobuchar, Moran introduce bipartisan legislation to support biorefineries, renewable chemicals, and biomanufacturing

Sens. Amy Klobuchar, D-Minn., and Jerry Moran, R-Kan., on July 31 announced the introduction of the Ag BIO Act. The legislation aims to update the USDA’s loan guarantee program to better support biorefining projects.

Upcoming Events