US biodiesel production ticks up in May, soybean oil use hits 70%

Source: U.S. Energy Information Administration

July 31, 2020

BY Ron Kotrba

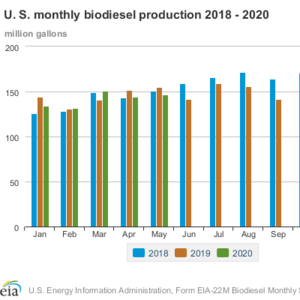

U.S. production of biodiesel rose slightly in May over April, according to data from the U.S. Energy Information Administration, as lockdowns from the coronavirus pandemic remained in place for many states during much of the month while other states began to reopen toward the end of May.

Biodiesel manufacturing in the U.S. hit 147 million gallons in May, four million gallons higher than April and four million gallons less than March.

Advertisement

Midwestern biodiesel production accounted for 76 percent of total U.S. production in May compared to 69 percent in April. Overall production came from 89 biodiesel plants with capacity of 2.5 billion gallons per year.

Producer sales of biodiesel in May included 71 million gallons sold as B100 and an additional 69 million gallons of B100 sold in biodiesel blends.

A total of nearly 1.11 billion pounds of feedstock was used in May to produce biodiesel, with soybean oil remaining the largest feedstock consumed at 778 million pounds—representing a 70 percent share of all feedstocks used—compared to 672 million pounds in April and 656 million pounds in March.

The domestic industry’s 70 percent reliance on soybean oil in May is a noteworthy increase from just three months prior, when the 132 million gallons of U.S. biodiesel production that occurred in February consumed nearly 1.01 billion pounds of feedstock, 575 million pounds of which was soybean oil, representing roughly 57 percent of feedstocks consumed that month.

Advertisement

Tallow consumption by U.S. biodiesel producers was cut in half in May compared to April, while yellow grease use was 43 million pounds in May vs. 71 million pounds in April and 115 million pounds in January. Distillers corn oil (DCO) use remained the same in May as in April at 84 million pounds per month, down by more than half compared to January’s consumption of 177 million pounds.

Naturally, one major factor for this trend in rising soybean oil and falling recycled greases for use in manufacturing U.S. biodiesel is the coronavirus pandemic, during which restaurants either closed entirely or significantly cut back output, meaning much less fryer oil being generated; and U.S. ethanol plants having cut production or idled, generating much less DCO for the market.

Related Stories

At the University of Missouri, plant biochemist Jay Thelen is using arabidopsis as a powerful model to explore ways to boost oil production — an important step toward creating more sustainable, plant-based energy sources.

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Total U.S. operable biofuels production capacity expanded in May, with gains for renewable diesel and a small decrease for ethanol, according to data released by the U.S. Energy Information Administration. Feedstock consumption was up.

The U.S Department of Energy Bioenergy Technologies Office, in partnership with the Algae Foundation and NREL, on July 21 announced the grand champion and top four winning teams of the 2023 - 2025 U.S. DOE AlgaePrize Competition.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

Upcoming Events