USGC: Southeast Asia DDGS demand grows in 2020

April 5, 2021

BY U.S. Grains Council

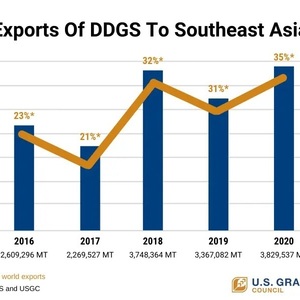

In the 2020 calendar year, more than one out of every three metric tons of distillers dried grains with solubles (DDGS) leaving the United States headed for ports in Southeast Asia and Oceania, illustrating how increased marketing efforts in the region by U.S. Grains Council have paid off despite the emergence of both African Swine Fever and COVID-19.

“The Council has been working on the ground here in Southeast Asia and Oceania for over a decade, expanding DDGS sales by providing technical expertise and connecting grain buyers and end-users with U.S. suppliers,” said Manuel Sanchez, USGC regional director for Southeast Asia. “As a result, U.S. DDGS demand in this dynamic region has increased significantly across all major markets in Southeast Asia.

“Today, U.S. DDGS is one of the most widely used feedstuffs in animal feed diets across Southeast Asia. The nutritional value makes it an excellent source of energy and protein and a great source of amino acids and phosphorus compared to most other feed ingredients.”

Despite the region experiencing major market-disrupting phytosanitary events in 2017 with the closing of the Vietnam market due to a quarantine pest finding and the 2019 near-closure of the market in Thailand due to the same insect occurrence, the Council was able to bring together industry stakeholders to ultimately resolve these issues and maintain the overall trajectory of U.S. DDGS into Southeast Asia.

Advertisement

Accelerating significantly over the past three years, U.S. DDGS purchases have increased from 2.60 million metric tons (337.19 million bushels in corn equivalent) in the 2016 calendar year to 3.83 million metric tons (497 million bushes in corn equivalent) in the 2020 calendar year, a jump from 23 percent of total worldwide DDGS exports to 35 percent.

Five of the 10 largest DDGS export markets are now in Southeast Asia: Vietnam, Indonesia, Thailand, the Philippines and New Zealand. Mexico, South Korea, Turkey, Japan and Canada round out the top 10.

In 2020, Vietnam was the largest importer of U.S. DDGS in Southeast Asia, buying 1.29 million metric tons (167.3 million bushels in corn equivalent). Indonesia followed with imports of 940,891 metric tons (122 million bushels in corn equivalent), while Thailand imported 840,446 metric tons (108.9 million bushels in corn equivalent), and the Philippines and New Zealand followed with 283,805 metric tons (36.8 million bushels in corn equivalent) and 261,413 metric tons (33.9 million bushels in corn equivalent), respectively.

Reasons for the uptick in U.S. DDGS purchases vary by country. With Council assistance, grain importers in Vietnam shifted in early 2020 from purchasing containers to ordering bulk vessels to secure feed ingredients. In Indonesia, the Council expanded engagement to reach more broiler and layer producers spread over the country’s extensive network of islands and, as a result, participants began DDGS trials and increased inclusion levels that increased demand.

Phytosanitary hurdles in Thailand notwithstanding, Council staff members are working on targeted technical education and trade servicing programs focused on inclusion of DDGS in shrimp, fin fish and marine species. Regional staff and consultants are also targeting the Philippines’ swine and poultry sectors as well as New Zealand’s dairy industry to increase DDGS interest.

Advertisement

“There is still plenty of room for growth as animal protein consumption continues to expand in the region,” Sanchez said. “We have recently begun focusing our market development efforts in both the aquaculture and dairy sectors in Southeast Asia – the next significant demand growth opportunities for U.S. DDGS.”

More than 50 countries imported U.S. DDGS in 2019/2020, and total U.S. DDGS exports were more than 10.5 million metric tons overall.

Read more about the Council’s DDGS work in Southeast Asia.

Related Stories

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Topsoe, a leading global provider of advanced technology and solutions for the energy transition, has been selected as the renewable diesel technology partner for CountryMark’s Mount Vernon, Indiana refinery.

Klobuchar, Moran introduce bipartisan legislation to support biorefineries, renewable chemicals, and biomanufacturing

Sens. Amy Klobuchar, D-Minn., and Jerry Moran, R-Kan., on July 31 announced the introduction of the Ag BIO Act. The legislation aims to update the USDA’s loan guarantee program to better support biorefining projects.

The U.S. exported 35,953.6 metric tons biodiesel and biodiesel blends of B30 or greater, according to data released by the USDA Foreign Agricultural Service on Aug. 5. Biodiesel imports were at 2,148.9 metric tons for the month.

XCF Global leverages Alfa Laval technology to enhance pretreatment capabilities at New Rise Reno facility

XCF Global Inc. on Aug. 5announced it leverages Alfa Laval Inc. pretreatment technology at its New Rise Reno biorefinery, a sustainable aviation fuel (SAF) plant located in Nevada. The pretreatment technology enhances feedstock flexibility at the plant.

Upcoming Events