Will the Upward Trend in Prices be Sustained?

September 23, 2013

BY Casey Whelan

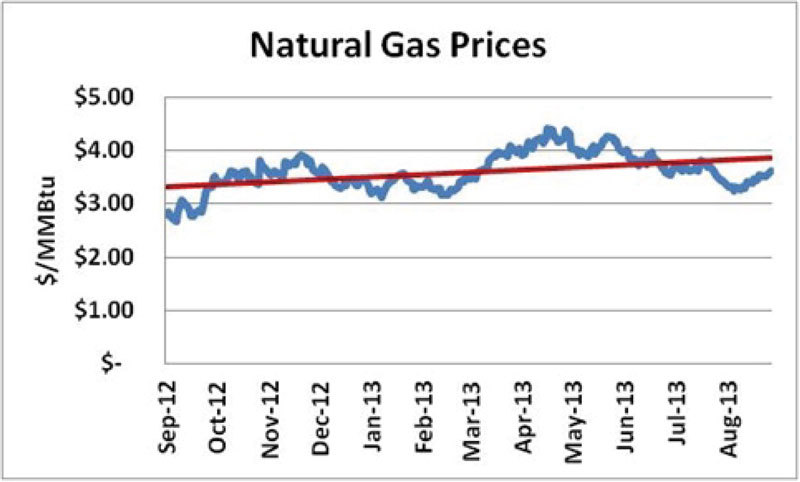

Sept. 3—Natural Gas prices are 55 percent lower than five years ago and the market price today, roughly $3.60 per MMBtu, feels like a bargain. Looking at a shorter timeline shows gas prices are now 29 percent higher than one year ago. As the chart shows, the market was under $3 per MMBtu one year ago and now rests above $3.50 per MMBtu. Market prices moved above $4.40 per MMBtu at the end of winter as storage inventories were drawn down due to the long and cold winter experienced over most of the nation. Moving through the summer, strong production pushed inventories back to comfortable levels, softening market prices. However, prices are still well above levels compared to one year ago. If the current trend continues, the market will move above $4 per MMBtu and may stay there on a sustained basis.

The futures market seems to confirm that higher prices may occur. For example, the January 2014 price approaches $4 per MMBtu while the January 2015 price is 8 percent higher at $4.27 per MMBtu. From a producer perspective, market prices above $4 per MMBtu encourage more aggressive pursuit of incremental supply, which is necessary to maintain a healthy supply, demand balance. While no consumer likes higher prices, it may create a degree of price stability. The key is to have a sufficiently high price to encourage development and incremental supply but not so high that economic activity is impacted.

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events