ADM: Bioproducts earnings down in Q4

January 30, 2020

BY Erin Krueger

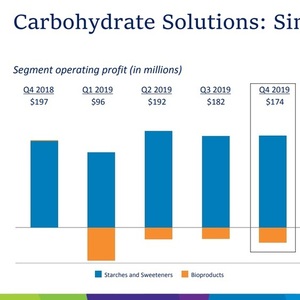

Archer Daniels Midland Co. has released fourth quarter financial results, reporting solid overall performance. Earnings for the company’s bioproducts segment were down due to unfavorable ethanol industry margins. ADM’s ag services and oilseeds segment, however, benefited from the recent renewable of the biodiesel tax credit.

AMD reported a $34 million fourth quarter loss for its bioproducts segment, compared to $2 million in operating profit reported for the same period last year. For the full year, the segment reported a loss of $159 million, compared to a segment operating profit of 2018 reported for 2018.

Advertisement

Advertisement

During an earnings call held Jan. 30, Juan Luciano, chairman and CEO of ADM, explained that bioproducts results were down during the fourth quarter due to continued unfavorable ethanol conditions and some risk management hedging losses.

Looking ahead into the first quarter of 2020, Luciano said ADM will change how it reports results for its carbohydrates solutions business, which currently contains the bioproducts segment and a business segment focused on starches and sweeteners. Moving ahead, the company will begin reporting carbohydrate solutions business results in two sub-segments. One is focused on starches and sweeteners and the second focused on Vantage Corn Processors, ADM’s newly created dry mill ethanol subsidiary. Luciano said VCP will cover the production from the subsidiary’s three dry mill ethanol plants and income from the distribution of ethanol produced at the company’s wet mill facilities. The new starches and sweeteners sub-segment will include the results of all wet mill operations, including ethanol production. Luciano said ADM expects VCP to continue to be impacted by challenging ethanol margins during the first quarter of 2020.

Also during the call, Ray Young, chief financial officer of ADM, noted that the impact of the passage of the retroactive biodiesel tax credit for 2018 and 2019 contributed $270 million net to the company’s ag services and oilseeds segment.

Advertisement

Advertisement

Overall, ADM reported $934 million in segment operating profit for the fourth quarter of 2019, up from $786 million for the same period of last year. Adjusted segment operating profit was $1.028 billion, up from $860 million. Earnings per share reached 90 cents for the quarter, up from 55 cents for the fourth quarter of 2018. Adjusted earnings per share reached $1.42, up from 88 cents for the same period of 2018.

Segment operating profit for the full year reached $2.948 billion, down from $3.273 billion in 2018. Adjusted segment operating profit for 2019 was $3.082 billion, down from $3.362 billion in 2018. Diluted earnings per common share were at $2.44 for 2109, down from $3.19 the previous year.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events