Analysis addresses RIN carryover and 2014 proposed RFS

FarmDoc Daily

December 31, 2013

BY Erin Krueger

A recent FarmDocDaily post authored by Nick Paulson, an assistant professor in the University of Illinois Department of Agricultural and Consumer Economics, addresses renewable identification number (RIN) stocks and the implications of the U.S. EPA’s proposed 2014 volume requirements for the renewable fuel standard.

In the post, Paulson notes that current data indicates that 1.7 billion RINs will be available for carryover into 2014, an estimate 500 million gallons higher than the carryover estimate made by the EPA in its 2014 RFS rulemaking. He also notes that the EPA ignored RIN carryover in setting the 2014 proposal, stating that RIN stock levels should remain positive to allow for the flexibility that the system as intended to provide.

Advertisement

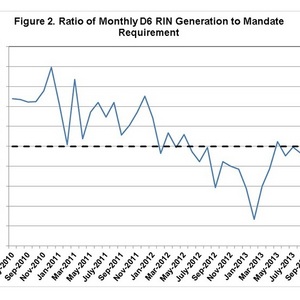

According to Paulson, D6 renewable fuel RIN generation averaged 1.1 billion gallons per month in 2013. Assuming that trend is maintained through December, total D6 RIN generation for 2013 will be approximately 12.3 billion. He also estimates that just under 568 million D5 advanced biofuel RINs will be generated in 2013.

Based on 2012 RINs carried over into 2013, 2013 production and the 2013 RFS requirements, Paulson estimates that there is potential for approximately 896 million D6 renewable fuel RINs will be carried over into 2014 along with about 806 million advanced RINs from the combined D3, D4 and D5 pools.

When the figures are adjusted to reflect the 20 percent rollover limits on the proposed 2014 mandate levels, Paulson finds that although the total RIN carry-in of the proposed mandate, 3.042 billion gallons) exceeds the 1.7 billion gallon estimate, the lower mandate for a combined pool of advanced biofuels (consisting of D3, D4 and D5 RINs) implies that only 440 million advanced RINs could be rolled over into 2014 and used as advanced RINs in 2014. The remaining advanced biofuel RINs would be carried over into 2014, but would have to be used to meet the renewable biofuel pool.

Advertisement

Essentially, Paulson’s analysis determined that while the reduced 2014 RFS proposal shouldn’t limited the total expected RIN carryover, it will impact the composition of carried over RINs.

Paulson’s full post can be seen here.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events