Analysis shows RIN prices did not affect gasoline prices in 2013

Informa Economics Inc.

January 7, 2014

BY Chris Hanson

An analysis from Informa Economics Inc. indicates renewable identification number (RIN) credits did not affect retail gasoline prices during 2013.

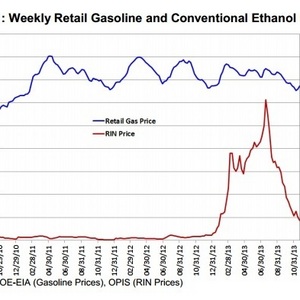

“In a nutshell, what we set out to do was take a look at some of the allegations that RIN prices contributed to a run-up in gasoline prices in 2013,” Scott Richman, senior vice president at Informa. “In the early 2013, the prices for both gasoline and RINs rose in this roughly coincidental timing and led some people to speculate that RIN prices were driving retail gasoline prices higher.”

Informa used statistical methods to explore any causal relationship between RIN prices and retail gas prices in 2013. The analysis determined that although both RIN and gasoline prices increased and remained elevated throughout the middle of the year, the changes had occurred for different reasons. “Based on both a statistical analysis and simply taking a look at the progression of prices, it can be concluded that RIN prices were not a significant cause of what happened to gasoline prices in the first quarter of 2013 and through the middle of 2013,” Richman said.

Advertisement

Advertisement

The statistical firm also examined the cause of higher gasoline prices, explained Crystal Carpenter, senior consultant from Informa. “The analysis showed that the primary driver of retail gasoline prices is crude oil prices,” she said.

The correlation between crude oil and gasoline prices weakened in Spring 2012 due mainly to the divergence between domestic and international crude oil prices. “There was an increase in inland oil stocks that caused domestic prices to weaken to international prices,” she said.

Advertisement

Advertisement

Seasonal demand and prices between different types of crude oil were other key factors that led to 95 percent of the historical movement of gasoline prices, Carpenter said.

“This analysis should put to rest the oil industry’s ridiculous assertion that RINs somehow affect the retail price of gasoline at the pump,” said Bob Dineen, president and CEO of the Renewable Fuel Association. “The bottom line is that RINs are free for refiners who purchase and blend required volumes of ethanol with gasoline. Only those refiners who stubbornly refuse to blend required ethanol volumes have a need to buy RINs on the open market, and in the highly competitive gasoline marketplace, there is no way they can pass those costs on to consumers and remain competitive with refiners and blenders who are blending more ethanol than required. Some refiners and blenders are actually profiting from the sale of RINs. The market is essentially a closed loop, with some participants incurring costs and other reaping profits. In the end, it’s a zero sum game, and the price a consumer pays for gasoline is unaffected.”

The report was commissioned by the RFA, and the results were planned to be submitted to the U.S. EPA during the comment period on the renewable fuel standard (RFS) proposal.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events