Bloomberg: global renewable investments down, but power share up

Bloomberg New Energy Finance

April 23, 2014

BY Anna Simet

While global investments in renewable energy technologies dropped in 2013, continuing a two-year trend, there are several silver linings to that observation, according to a new report by Bloomberg New Energy Finance.

One is that while investments fell for the second consecutive year—down 14 percent to reach $214 billion globally—it may be partially due to sharply reduced costs and increased efficiency of certain technologies, such as solar photovoltaic systems and onshore wind projects.

Advertisement

Additionally, while global investments are down, renewables continued to expand its share of global power generation. Excluding large hydro, which comprised of 43.6 percent of new power capacity added in 2013, renewable energy raised its share of total generation worldwide from 7.8 percent to 8.5 percent from 2012 to 2013, according to the report, and reduced CO2 emissions by about 1.2 billion metric tons.

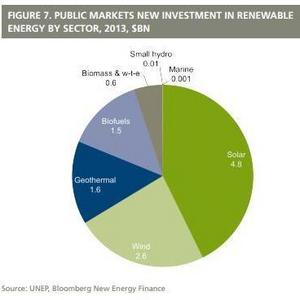

For biofuels, global investments fell to $5 billion, and $8 billion for biomass and waste-to-energy, down 26 percent and 28 percent, respectively. Biofuels saw the lowest investment total since 2004, and for biomass, the lowest since 2005. Developing countries made up the most investment in biomass and biofuels capacities, as well as geothermal.

The report suggests that besides technology cost reductions, worries about future policy support for renewables delayed investment decisions in countries including the U.S., Germany, India, the U.K., attributed the decline in overall investment in 2013.

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events