Bunge, BP form bioenergy joint venture in Brazil

July 22, 2019

BY Erin Krueger

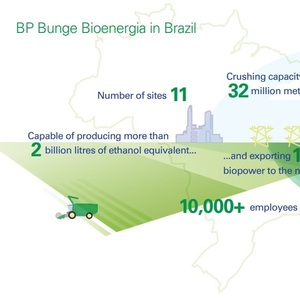

Bunge Ltd. and BP plc announced July 22 the formation of BP Bunge Bioenergia, a 50:50 joint venture bioenergy company in Brazil that will operate 11 sugarcane mills to produce ethanol, sugar and renewable electricity.

Under the agreement, BP and Bunge will each contribute their existing Brazilian biofuel, biopower and sugar businesses into the new, equally owned, standalone joint venture. On completion, BP will pay Bunge $75 million, subject to customary closing adjustments, and the joint venture will assume $700 million of non-recourse debt associated with Bunge’s assets. Subject to satisfaction of conditions precedent, including obtaining the necessary regulatory clearances and approval, the deal is expected to be complete in the fourth quarter of 2019.

Advertisement

Advertisement

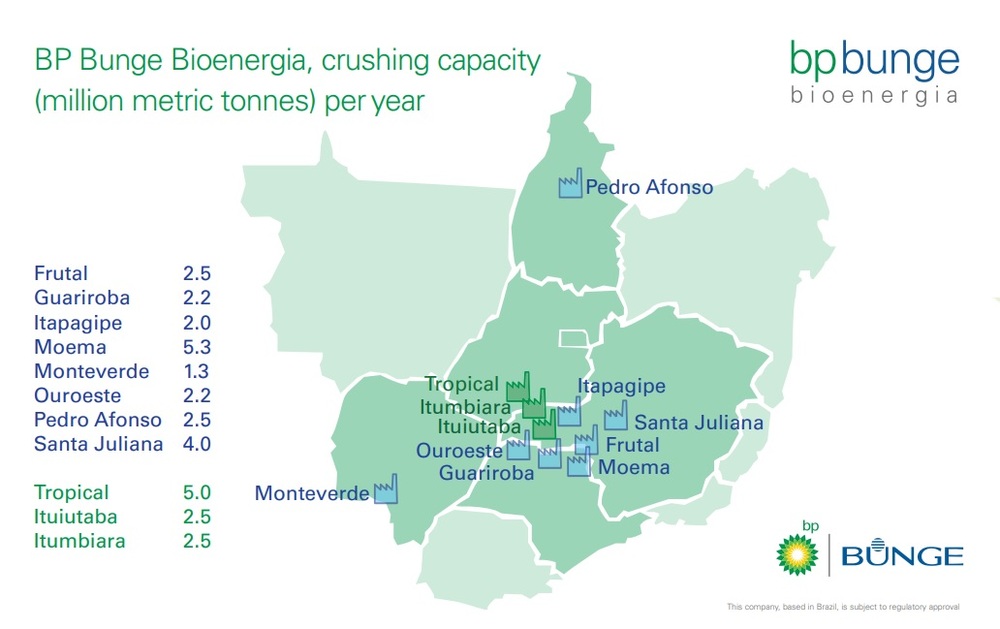

The 11 sugarcane mills have the capacity to process 32 million metric tons of sugarcane each year. In 2018, the mills produced approximately 2.2 billion liters (581.18 million gallons) of ethanol. The sites also exported approximately 1,200 gigawatt hours of low-carbon biopower to the national grid. The two businesses to be combined currently employ more than 10,000 people in Brazil.

The new business is expected to be headquartered in São Paulo and will become Brazil’s second largest ethanol producer, ranked by effective sugarcane crushing capacity. Mario Lindenhayn from BP will be executive chairman and Geovane Consul from Bunge will be CEO. BP and Bunge will have equal representation on the board of directors.

Advertisement

Advertisement

"This partnership with BP represents a major portfolio optimization milestone for Bunge which allows us to reduce our current exposure to sugar milling, strengthen our balance sheet and focus on our core businesses,” said Gregory A. Hchman, CEO of Bunge. “We have a strong, committed partner in BP, as well as flexibility in the medium and long term for further monetization, with full exit potential via an IPO or other strategic route."

“This is another large-scale example of BP’s commitment to play a leading role in a rapid transition to a low carbon future,” said Bob Dudley, BP group chief executive. “Biofuels will be an essential part of delivering the energy transition and Brazil is leading the way in showing how they can be used at scale, reducing emissions from transport. This combination will unlock new possibilities for improved efficiency and future growth in this key market."

Related Stories

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

Upcoming Events