Carbon Connector

PHOTO: NRG

July 25, 2021

BY Lisa Gibson

Stretching across five states and collecting carbon dioxide from 30 ethanol plants for long-term underground sequestration, the $4.5 billion Summit Carbon Solutions pipeline project is the largest capture and storage project in the world. With a target completion date three years out, engineering and design work is underway, says Justin Kirchhoff, president of Summit Ag Investors with Summit Agricultural Group, Summit Carbon Solutions’ parent company.

“Nothing we’re doing here is new,” Kirchhoff says. “We’re just doing it on a much larger scale. The technology and safety record around these technologies are really well-known.”

Brad Crabtree, director of the Carbon Capture Coalition, agrees. “The technology isn’t new,” he says. “The CO2 has been captured from ethanol plants for many, many years. Not just from a climate standpoint, but even just from a business standpoint to produce CO2 for a whole range of purposes.

“I think the project is groundbreaking because of the actual size of the project in terms of carbon captured, sequestration and [how much CO2 will be] stored geologically—10 million tons,” Crabtree says.

The Business Model

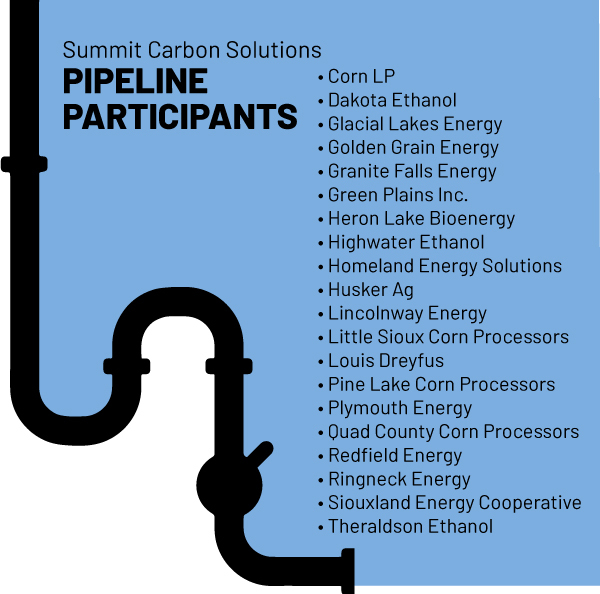

Summit Carbon Solutions has signed long-term offtake agreements with 30 ethanol plants in five states: North Dakota, South Dakota, Minnesota, Iowa and Nebraska, Kirchhoff says. “We’ve been fortunate to have strong support from all of our partner plants and it’s clear lower carbon and sustainability is here to say.”

The pipeline will end in North Dakota, where the carbon will be geologically stored long-term. “We evaluated a number of areas and North Dakota was the obvious choice,” Kirchhoff says. “We’ve really been welcomed by the state. (Gov. Doug) Burgum is very supportive of carbon capture and sequestration. And only two states have primacy over Class 6 wells—North Dakota and Wyoming are the only two that have regulatory jurisdiction over carbon sequestration wells.”

Summit Carbon Solutions also partnered with the Energy & Environmental Research Center at the University of North Dakota to determine injection well siting and feasibility. “EERC has been fantastic to work with,” Kirchhoff says. “And the oil industry in North Dakota and the advancements and understanding of geology there really made us comfortable moving forward. The broad understanding of North Dakota geology has definitely been helpful.”

Summit Carbon Solutions will own the pipeline and capture equipment at all the plants, fully footing the capital costs. Trimeric Corp. is engineering the carbon capture at the plants. Partner plants can opt into the initial investment, and Kirchhoff says he’s optimistic a number of them will. The essential benefit for participating ethanol plants initially is a halved carbon intensity (CI) score, he says.

“We would expect that our CI scores would go down somewhere between 40% to 50%,” says Jim Seurer, CEO of Glacial Lakes Energy, whose four South Dakota plants are participating in the project. “Right now, we’re not capturing CO2, so that’s part of the score.”

Seurer adds, “We’re confident in Summit’s ability to get us there. They have a good plan, a good strategy and they’re adding very, very professional folks on their team. We feel good about the whole project.”

GLE has been in contact with Trimeric to begin the project. “It’s just a matter of time before they’re on site,” Seurer says. GLE is considering a $60 million investment in the project, he adds. “We are about 10% of the 3.6 billion gallons that are going to be represented. We’re excited. For us to participate in this, with the professionalism and the expertise that Summit brings is just tremendous. It’s great we can partner up with a team like Summit and move this forward.”

Tax Credit Boost

The enhancement of the 2018 45Q tax credit was a critical project catalyst for Summit Carbon Solutions, Kirchhoff says. “We spent eight to 12 months meeting with ethanol plants and describing the opportunity. From our perspective, the most powerful part of this is we really do view it as a partnership between Summit and ethanol plants.”

Crabtree says the project is exactly what 45Q was designed to support. “The tax credit accrues to the owner of the carbon capture equipment,” Crabtree says. “The reason behind that is you want the flexibility for the owner to be an entity that can take advantage of the tax credit. That’s exactly why we designed that flexibility in the 45Q credit.”

Many industries don’t have background or interest in transporting and storing gases like carbon dioxide, Crabtree explains. “They’d much rather take advantage of a system in which another company comes in and takes care of that.

“One of the reasons the original 45Q did not work is the owner of the facility had to be the owner and handler of the equipment. But they don’t have expertise. That was simply an oversight. It wasn’t intentionally done that way.”

And ethanol is the perfect industry for the project, Crabtree says. “Ethanol is the ideal project for early carbon capture because the stream coming off fermentation is essentially a pure stream of CO2.

“When the FUTURE Act passed in 2018, with 45Q, I speculated that I think the ethanol industry may become the first industry in the world to capture and manage a majority of its CO2 emissions,” Crabtree adds. “That, in itself, is significant.”

He might be right, as several other sequestration projects in the industry—including a Valero partnership pipeline intending to span 1,200 miles through Nebraska, Iowa, South Dakota, Minnesota and Illinois, would touch even more U.S. ethanol production. “If those projects move forward, we’d be capturing the bulk of the ethanol carbon and that’s really extraordinary,” Crabtree says.

Beyond Valero and Summit Carbon Solutions’ large pipeline projects, producers with carbon capture and storage systems operating or under development include ADM in Illinois, Red Trail Energy in North Dakota, Blue Flint in North Dakota, White Energy in Texas, Alto Ingredients in Illinois, and One Earth Energy in Illinois.

In addition, Battelle and Catahoula Resources announced in early June that they will partner to offer carbon capture and storage for ethanol plants across the U.S.

Transformation

The Summit Carbon Solutions project is beneficial for other reasons, too. “A project of this size will be transformative in how people perceive the industry and how people perceive measures to address climate change,” Crabtree says. “A project like this will start to shift people’s perception of the climate challenge into one of a carbon management opportunity—thinking of it as more of an economic development potential.”

Seurer emphasizes the outlook and sustainability focus of the future. “Certainly, there’s the growing low carbon market out there. We’re looking ahead and we feel this is not just a passing idea. It’s going to be something that we all need to get onboard with. In order to compete in this new world order, we’re going to have to and want to go this direction.”

Seurer emphasizes the lack of credit to corn as a carbon sequestration tool itself. “I think ethanol itself, if given proper credit for what the corn plant does, we’re going to be very, very low on the carbon intensity scale.”

With the combination of capture and due credit for corn’s carbon reduction, ethanol could be the lowest carbon fuel in existence, even surpassing electric vehicles, Seurer says.

“And the continued global direction of a lower carbon footprint across the globe would suggest that there’s a value there and folks are willing to recognize that value,” he adds. “Large and small businesses are willing to recognize that value.

“We could be considered zero carbon.”

Author: Lisa Gibson

Questions: editor@bbiinternational.com

Advertisement

Advertisement

Related Stories

CoBank latest quarterly research report highlights current challenges facing the biobased diesel industry. The report cites policy uncertainty and trade disruptions due to tariff disputes as factors impacting biofuel producers.

The U.S. EIA on April 15 released its Annual Energy Outlook 2025, which includes energy trend projections through 2050. The U.S. DOE, however, is cautioning that the forecasts do not reflect the Trump administration’s energy policy changes.

Iowa Secretary of Agriculture Mike Naig on April 10 announced that the Iowa Renewable Fuels Infrastructure Program board recently approved 114 project applications from Iowa gas stations, totaling more than $2.88 million.

The USDA on April 14 announced the cancellation of its Partnerships for Climate-Smart Commodities program. Select projects that meet certain requirements may continue under a new Advancing Markets for Producers initiative.

The governors of Iowa, Nebraska, South Dakota and Missouri on April 10 sent a letter to U.S. EPA Administrator Lee Zeldin urging the agency to set higher Renewable Fuel Standard renewable volume obligations (RVOs).

Upcoming Events