CoBank: Policy uncertainty negatively impacts biobased diesel producers

SOURCE: CoBank

April 15, 2025

BY Erin Voegele

CoBank on April 10 released its latest quarterly research report, which highlights current challenges facing the biobased diesel industry. The report cites policy uncertainty and trade disruptions due to tariff disputes as factors impacting biofuel producers.

Within the report, CoBank stresses that upcoming Renewable Fuel Standard renewable volume obligations (RVOs) and implementation of the 45Z clean fuels production credit will determine the trajectory of biofuels demand and production. The EPA could propose 2026 RVOs as soon as this spring, which would allow the agency to finalize a rulemaking before then end of this year. CoBank said the upcoming 2026 RVO could bring some certainty to the biofuels industry if RVO levels more closely align with production capacity.

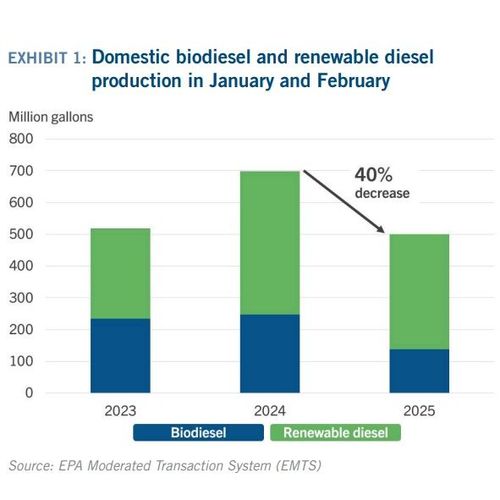

According to CoBank, biodiesel and renewable diesel production fell by 41% in January and February when compared to the same period of 2024. The report attributes the decline to the absence of the $1 per gallon blenders’ tax credit and uncertainty over the 45Z credit. “Margin pressure exceeded projections,” CoBank wrote in the report. “Biodiesel producers were operating at 39% nameplate capacity in February, while renewable diesel producers were running at 56% (vs. 72% last year) and seeing thin margins. The pullback in production is greater than anticipated, revealing even larger plants are making the economic decision to not run or pull forward maintenance.”

Advertisement

Advertisement

Assuming biomass-based diesel RVOs for 2026 are not set at or below the 2025 level of 3.35 billion gallons, CoBank said biobased diesel production will need to pick up this quarter to generate enough renewable identification numbers (RINs) to meet the 2025 RVOs.

A full copy of the report is available on the CoBank website

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events