CoBank discusses potential boom in renewable diesel capacity

September 29, 2022

BY Erin Krueger

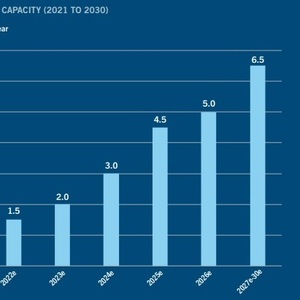

CoBank on Sept. 27 published a report that calls renewable diesel the most exciting growth opportunity in the U.S. biofuels space, with proposed capacity increasing from approximately 1 billion gallons in 2021 to 6.5 billion gallons by 2030. That level of capacity would equate to approximately 15 percent of today’s diesel market, according to the report.

Soybean oil is currently the primary renewable diesel feedstock used in the U.S. Theoretically, to support the expected 5.5 billion gallon growth in renewable diesel production capacity, CoBank estimates soybean production would need to grow by 3.4 billion bushels. Even if the U.S. retained all of its soybean exports, projected at 2.5 billion bushels in 2030, biofuel producers would still be short 927 million bushels. Using a future projected yield estimate of 51.9 bushels per acre, meeting the needed production would require 17.9 million more soybean acres, according to CoBank.

Advertisement

Advertisement

Renewable diesel, however, can be produced from a variety of other feedstocks. Besides importing soybeans, alternatives to shifting massive farm acreage would include growing other types of oilseeds, such as canola and sunflower, at larger scale, importing other vegetable oils, and/or using other feedstocks, such as beef tallow, CoBank said in the report.

In the report, CoBank also notes that it expects the recently signed Inflation Reduction Act of 2022 to a be a catalyst for biofuels sector growth over the next decade. Provisions of the law that are particularly beneficial to the biofuels industry include the $500 million allocated to support biofuel infrastructure development; the extension of the $1 per gallon tax credit for biomass-based diesel through 2024; the newly established clean fuel production tax credit and enhanced carbon capture and storage credits/payments; and a temporary tax credit for sustainable aviation fuel (SAF).

Advertisement

Advertisement

Related Stories

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

Upcoming Events