CoBank: US ethanol sector well positioned for H2 of 2021

July 13, 2021

BY Erin Krueger

CoBank’s Knowledge Exchange released its second quarter report on July 8, reporting that the U.S. fuel ethanol sector outperformed expectations during the three-month period and is well positioned for the second half of 2021.

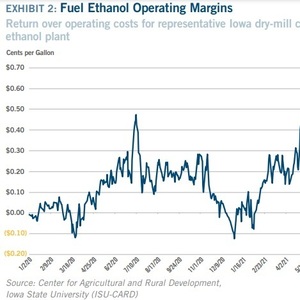

According to CoBank, several key demand drivers underpin its outlook for ethanol, including general economic growth, seasonal summer driving, and more people driving as they return to offices and classrooms. These factors helped increase fuel ethanol production in the second quarter, with production recently trending above 16 billion gallons, CoBank said. The report also states that average daily operating margins more than doubled during the second quarter, reaching 26 cents.

Advertisement

Advertisement

Regarding E15, CoBank’s report indicates that 48 states have now enacted legislation allowing for the sale of gasoline containing up to 15 percent ethanol. The report, however, does not discuss the expected impact of the D.C. Circuit Court of Appeal’s July 2 reversal of the U.S. EPA’s 2019 E15 rule.

The report does note that biofuel policy continues to be a major area of friction in Washington and between ethanol producers and fossil fuel refineries. CoBank said its unclear where biofuels, fossil fuels, and electric-powered vehicles will fit in under a final infrastructure package. The report also cites the U.S. Supreme Court’s recent ruling on small refinery exemptions (SREs) as a negative development for the ethanol industry.

In addition, CoBank said that electric vehicle adoption, a long-term threat to ethanol, is powering ahead.

Advertisement

Advertisement

Grain prices will also continue to impact ethanol producers, according to report. CoBank said corn prices hit a nine-year high during the second quarter. Moving forward, elevated price volatility is expected to continue.

Additional information, including a full copy of the report, is available on the CoBank website.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events