DDGS sales to Turkey soar following USGC marketing programs

U.S. Grains Council

October 30, 2018

BY U.S. Grains Council

Promotion and market development for U.S. distillers dried grains with solubes (DDGS) has been a mainstay of the U.S. Grains Council’s work for more than a decade, supporting a market of approximately 11 million metric tons exported annually for use in livestock feed. In 2017, as China began to erect trade barriers to U.S. DDGS exports, the Council began aggressively seeking new and alternative markets for the product.

The Council used Market Access Program funds to conduct a conference in Rome, Italy, in June 2017 to host buyers from North Africa, Europe and the Middle East. This event was meant to highlight the near-term buying opportunity and connect end-users from both regions with U.S. farmers, grain suppliers and technology companies to make or negotiate sales.

Advertisement

Advertisement

The conference specifically targeted six major feed grain importing companies from Turkey, ensuring they got the latest information on the global market and trends, bulk and container transportation and technical specifications and nutritional profiles for both DDGS and corn gluten. Turkish attendees also had the opportunity to connect or do business during the meeting.

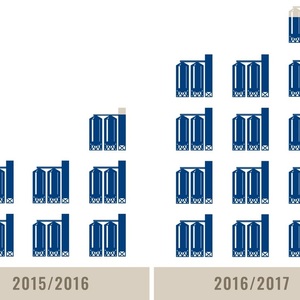

As a result of the 2017 conference, imports of U.S. DDGS by Turkey surged. In the 2016/2017 marketing year, Turkey was the second largest buyer of U.S. DDGS with 1.36 million tons of imports, nearly doubling the total from the prior marketing year. Imports of U.S. DDGS increased by 669,000 tons with a value of $104.8 million over the previous year’s imports.

Advertisement

Advertisement

The Council invested approximatively $150,000 in 2017 in marketing activities for DDGS in Turkey, generating a return on investment of (ROI) of $698 for every $1 of MAP funds invested.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events