DDGS valued at 89 percent of corn in 6 year average

FarmDocDaily

July 16, 2013

BY Susanne Retka Schill

While the pricing of distillers dried grains with solubles (DDGS) is primarily explained by the relative value of energy and protein and corn and soybean meal prices, University of Illinois economists Scot Irwin and Darrel Good find there is substantial variation to those relationships.

In the recent analysis, “Understanding the Pricing of Distillers Grains,” the economists note that consumption of distillers grains in the domestic market is estimated to be approaching 30 million tons a year. “Consumption of grains and soybean meal in domestic livestock feeding is near 180 million tons per year, so that [distillers grains] now account for a sizable share of domestic livestock feed and accounts for much of the decline in feeding of whole corn since 2007-’08.”

Advertisement

Advertisement

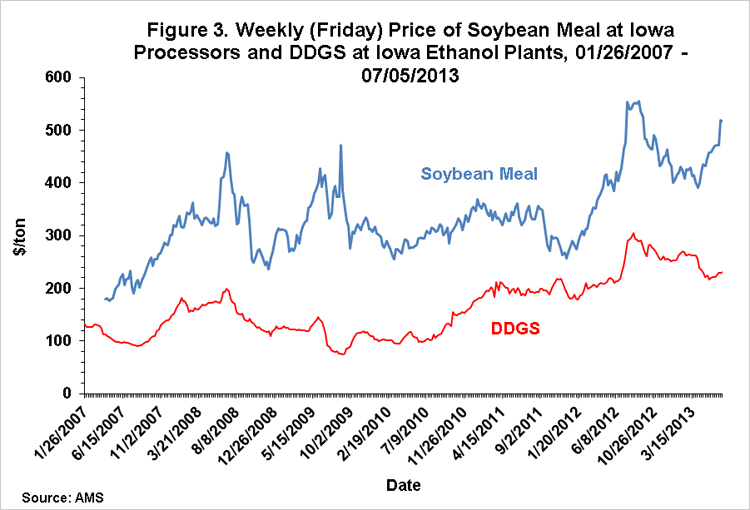

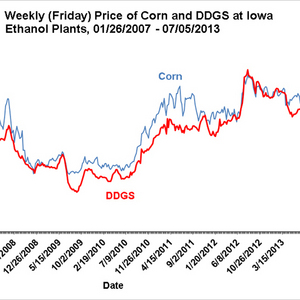

Distillers grains prices have ranged between less than 70 to nearly 110 percent of the value of corn, with the average being 89 percent from January 2007 through July 2013, as quoted by the USDA Agricultural Marketing Service for Iowa ethanol plants. The pricing patterns of distillers grains follow soybean meal as well, they added, “with DDGS priced at a fairly large discount to soybean meal.”

The economists used a simple linear regression model to compare the price patterns. “The estimated coefficients of the model indicated that DDGS prices changed by 85 cents per ton for each $1 per ton change in the price of corn and that DDGS prices changed by 11 cents per ton for each $1 per ton change in the price of soybean meal. The model estimates indicated that the combination of corn and soybean meal prices explained 92 percent of the variation in DDGS prices over the period studied.” The model wasn’t perfect, however, they added. “The magnitude of the price relationships seems reasonable and the overall ‘fit’ of the estimated price relationships is quite good. Still, the unexplained variation in the price of DDGs is relatively high, with the model having a standard error of about $16.75 per ton.”

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

Upcoming Events