DOE: Renewable diesel jobs up 7.3% in 2023

SOURCE: U.S. Department of Energy

August 28, 2024

BY Erin Voegele

The U.S. Department of Energy on Aug. 28 released its annual U.S. Energy and Employment Report (USEER), reporting that employment in the renewable diesel sector grew by an impressive 7.3% last year, the fastest growth rate in the U.S. fuels sector. Renewable diesel jobs are expected to increase an additional 2.5% this year, with biodiesel jobs expected to increase 5.9%, according to the DOE.

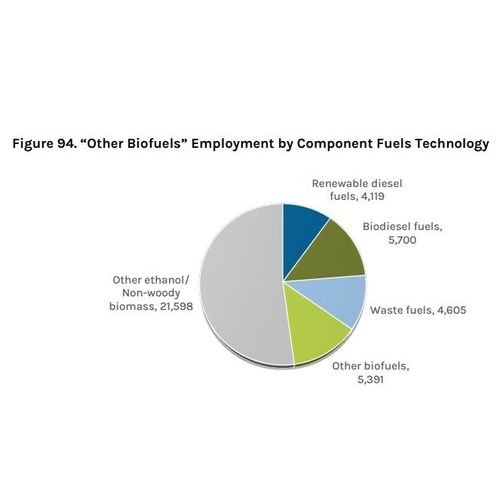

The DOE’s USEER reports data on renewable diesel and biodiesel employment under the category of “other biofuels,” which also encompasses jobs associated with the production of fuels from non-wood biomass, waste, and ethanol produced from feedstocks other than corn.

Advertisement

Advertisement

Businesses in “other biofuels” employed 41,412 workers last year, up 3.1% when compared to 2022. The largest jobs gains were in the professional and business services industry. Most businesses within “other biofuels" expect to see employment growth in 2024.

Within the “other biofuels” workforce, 33% of workers identified as female, compared with 26% in the energy workforce overall and 47% in the national workforce overall. Veterans were more represented in the “other biofuels” workforce at 11% when compared to the energy workforce average of 9%.

Of the 41,412 workers employed in “other biofuels,” 27,160 worked in business and professional services, 7,624 worked in wholesale trade, 3,778 worked in manufacturing, 2,747 worked in agriculture and forestry, and 104 worked in other services. The vast majority of employers across all of these industries reported that hiring was very difficult or somewhat difficult last year.

Advertisement

Advertisement

When broken down by technology type, the 41,412 workers include 4,199 in renewable diesel, 5,700 in biodiesel, 4,605 in waste fuels, 5,391 in other fuels, and 21,598 in other ethanol/non-woody biomass.

A full copy of the report is available on the DOE website.

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events