Dyadic releases annual results, calls 2014 a turning point

Dyadic International Inc.

March 16, 2015

BY Erin Krueger

Dyadic International Inc. recently released 2014 financial results, reporting revenue of $12.5 million, down from $17.1 million the prior year. The decrease is primarily attributed to a $6 million BASF upfront license fee in 2013. The decrease, however, was partially offset by 53 percent growth in research and development revenue of $710,000. The company also received $700,000 in milestone payments from Abengoa and BASF. Excluding 2013 upfront BASF license fee, revenue increased $1.4 million, or 12 percent.

Net product-related revenue was flat at $9.8 million. Dyadic indicated sales for last year were driven by growth in the starch and alcohol markets, offset by lower sales to the textile market. Research and development revenue increased to $2 million, up from $1.3 million in 2013. The increase is attributed to a higher number of externally funded projects performed at the company’s expanded research facility in the Netherlands.

Advertisement

Gross profit was $4.3 million, down from $7.4 million the previous year. Dyadic attributed the decrease to the reduction of the 100 percent margin BASF upfront license fee. The decrease in license fee revenues was partially offset by higher gross profits from product related sales, research and development revenues, and the first payments for the Abengoa Hugoton facility and a research milestone from BASF. Excluding the upfront BASF license fee, gross profit increased $2.9 million, or 208 percent.

Dyadic reported a net loss of $6 million, or 18 cents per basic and diluted share, compared to a net loss of $480,000, or 1 cent per basic and diluted share, in 2013.

During an investor call to discuss the annual results, Mark Emalfarb, president and CEO of Dyadic, called 2014 a turning point for the company. “We improved the operations of our enzyme business to enhance manufacturing processes, cost controls, higher-margin, product mix, resulting in higher margins, he said, adding that the company has also expanded its leadership team over the past two years.

Advertisement

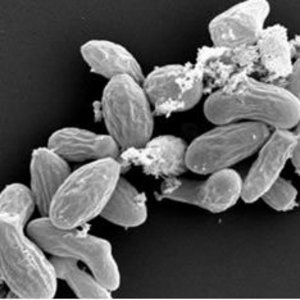

According to Emalfarb, Dyadic has begun the second expansion of its research facility in the Netherlands. He also noted the science behind the company’s C1 technology has never been better. “The C1 expression system continues to prove itself as one of the industry-leading system for turning DNA into products,” he said.

Dyadic’s C1 LC strain is achieving record high yields in some research programs, Emalfarb continued, noting the company has achieved more than 50 grams per liter of the target protein using that strain. Dyadic’s GC strain, which is used to produce the CMAX product for second-generation biofuel applications, continues to reach record productivity, he continued, with more than 100 grams per liter of total protein. “These high yields translate directly into lower-cost manufacturing processes for ourselves, our licensees and collaborators,” Emalfarb said.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events