EIA maintains 2021, 2022 ethanol production forecasts

September 8, 2021

BY Erin Voegele

The U.S. Energy Information Administration maintained its 2021 and 2022 forecasts for ethanol production in its latest Short-Term Energy Outlook, released Sept. 8. The forecast for 2021 ethanol blending was reduced slightly.

The EIA currently predicts fuel ethanol production will average 970,000 barrels per day this year, up from 910,000 barrels per day in 2020. In 2022, ethanol production is currently expected to average 1.01 million barrels per day.

On a quarterly basis, ethanol production is expected to average 990,000 million barrels per day during the third quarter of this year, falling to 980,000 barrels per day in the fourth quarter. In 2022, ethanol production is expected to average 980,000 barrels per day in the first quarter, 1.01 million barrels per day in the second quarter, 1.02 million barrels per day in the third quarter, and 1.01 million barrels per day in the fourth quarter.

Advertisement

Advertisement

Ethanol blending is currently expected to average 890,000 barrels per day this year, down when compared to the 900,000 barrels per day forecast made in the August STEO. Moving into 2022, ethanol blending is expected to increase to an average of 920,000 barrels per day, a forecast maintained from last month’s STEO. Ethanol blending averagede 820,000 barresl per day in 2020.

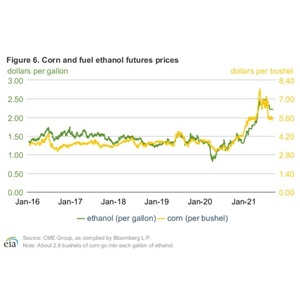

In the September STEO, the EIA reports that corn and ethanol prices have decreased slightly since corn prices peaked at $7.73 per bushels on May 7 and ethanol prices peaked at $2.48 per gallon in late June. According to the EIA, the front-month futures price of corn closed at $5.16 per bushel on Sept. 2, an increase of $1.67 per bushel from Sept. 2, 2020, but $2.57 per bushel lower than the peak price on May 7. The front-month futures price of fuel ethanol settled at $2.22 per gallon on Sept. 2, 2021, an increase of 86 cents per gal from Sept. 2, 2020, and 6 cents per gal higher than the frontmonth RBOB contract.

Advertisement

Advertisement

The agency also noted that the fuel ethanol-corn crush spread has been positive since mid-July after a few atypical months of negative spreads.

According to the EIA, the decrease in fuel ethanol prices is monthly the result of lower prices for corn. Corn prices increased during the first half of the year due to high demand in China, concerns of low production as a result of cold weather in the Midwest, and a La Nina weather pattern that brought hot and dry weather to Brazil and Argentina. Corn prices have come down since June, according to the EIA, as a result of increased planted corn acreage, increased production forecasts in the U.S., and uncertain demand in Asia.

The EIA also noted that uncertainty concerning Renewable Fuel Standard renewable volume obligations (RVOs) for 2021 has supported high renewable identification number (RIN) demand and ethanol prices.

Related Stories

A small but increasing amount of biodiesel in the United States is consumed in the residential, commercial, and electric power sectors, according to new estimates now published in the U.S. EIA’s State Energy Data System.

IAG and Microsoft are extending their 2023 co-funded purchase agreement for SAF by five years. The SAF used under the agreement will be produced by Phillips 66’s Humberside refinery and LanzaJet’s facility in the U.S.

U.S. exports of biodiesel and biodiesel blends of B30 or greater fell to 7,849.6 metric tons in February, according to data released by the USDA Foreign Agricultural Service on April 3. Biodiesel imports were at 21,964.9 metric tons for the month.

Neste and DB Schenker, a logistics service provider, have collaborated to work towards expanding DB Schenker’s adoption of Neste MY Renewable Diesel in Asia-Pacific. DB Schenker trialed the fuel from December 2024 to February 2025 in Singapore.

The International Air Transport Association has launched the Sustainable Aviation Fuel (SAF) Registry with its release to the Civil Aviation Decarbonization Organization. The registry is now live and under CADO management.

Upcoming Events