EIA predicts steep growth in US renewable diesel capacity

July 22, 2021

BY Erin Krueger

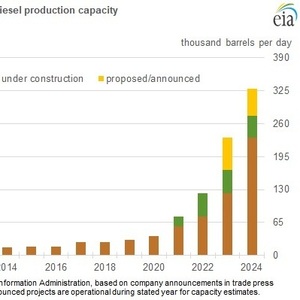

The U.S. Energy Information Administration released data on July 21 forecasting that U.S. renewable diesel production capacity will reach 5.1 billion gallons per year (330,000 barrels per day) by 2024, up from an estimated 600 MMgy (38,000 barrels per day) in 2020. The agency said growing targets for state and federal renewable fuel programs and incentives for renewable diesel production are driving the expected expansion.

According to the EIA, much of the expected capacity increase will come from retrofitting idle petroleum refineries. The agency offers Marathon Petroleum’s refinery in Martinez, California, and the Phillips 66 refinery in Rodeo, California, as two examples of oil refineries that are currently converting to renewable diesel production.

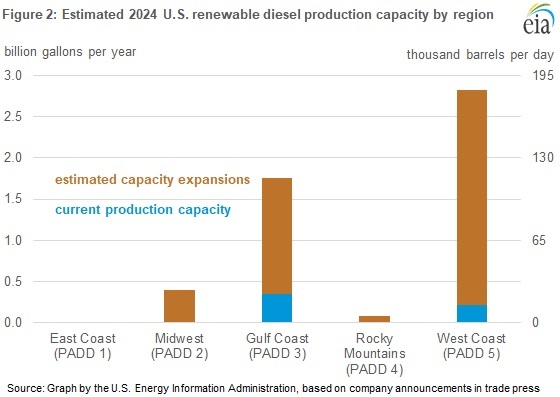

Currently, nearly all U.S. imports of renewable diesel enter the country in the West Coast where the fuel is used to meet Low Carbon Fuel Standard targets in California. Most existing U.S. renewable diesel capacity, however, is located in on the Gulf Coast near existing oil refineries. Moving forward, the EIA predicts the majority of new U.S. renewable diesel capacity will be built on the West Coast to serve nearby low carbon fuel markets, while the remainder will likely be built on the Gulf Coast to capitalize on existing refinery infrastructure.

Based on its capacity estimates, the EIA said it predicts renewable diesel production capacity could represent 20 percent of total diesel production on the West Coast by 2024 and 4 percent of total estimated diesel production capacity on the Gulf Coast. Across the entire U.S., renewable diesel capacity would account for 5 percent of total diesel production capacity in 2024.

Advertisement

Advertisement

Additional information is available on the EIA’s This Week in Petroleum report, released July 21.

Advertisement

Advertisement

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events