EIA: US ethanol plant nameplate capacity up in 2019

August 27, 2019

BY Erin Krueger

The U.S. Energy Information Administration released updated data on U.S. ethanol plant capacity on Aug. 26. The number of ethanol plants remained stable between 2018 and 2019, but total nameplate capacity was up slightly.

While the total number of operational ethanol plants remained stable between Jan. 1, 2018 and Jan. 1, 2019, the EIA data shows there were regional changes to plant distribution. Petroleum Administration for Defense District (PADD) 1, comprised of states along the East Coast, and PADD 3, which includes states in the Gulf Coast, each lost one plant. PADD 2, located in the Midwest, gained two plants. No changes were reported for PADD 4, which is the Rocky Mountain region, or PADD 5, which includes the West Coast.

Advertisement

Advertisement

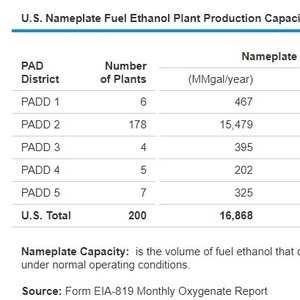

As of Jan. 1, 2019, the EIA reports that the U.S. had 200 operational ethanol plants, including six plants in PADD 1, 178 plants in PADD 2, four plants in PADD 3, five plants in PADD 4 and seven plants in PADD 5. That compares to 200 operational plants as of Jan. 1, 2018, including seven plants in PADD 1, 176 plants in PADD 2, five plants in PADD 3, five plants in PADD 4 and seven plants in PADD 5.

Total plant capacity increased from 16.542 billion gallons per year at the beginning of 2018 to 16.868 billion gallons per year at the beginning of 2019, a gain of 326 MMgy.

Advertisement

Advertisement

In PADD 1, capacity fell from 529 MMgy in 2018 to 467 MMgy in 2019. Capacity in PADD 2 increased from 15.046 billion gallons per year in 208 to 15.479 billion gallons per year in 2019. Capacity fell in PADD 3, from 446 MMgy in 2018 to 395 MMgy in 2019. Capacity in PADD 4 increased slightly, from 193 MMgy in 2018 to 202 MMgy in 209. Capacity in PADD 5 was stable at 325 MMgy in both years.

Additional data is available on the EIA website.

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events