Ethanol exports up to 1 billion gallons expected for 2014

FarmDoc Daily

March 10, 2014

BY Susanne Retka Schill

Ethanol exports are a bright spot for producers in a year of uncertainty due to the U.S. EPA’s proposed 2014 renewable volume obligations. “Continued strength in foreign demand could lead to ethanol exports in the range of 600 million to 1 billion gallons,” USDA senior economist Seth Meyer and University of Illinois economist Nick Paulson wrote in their March 7 FarmDocDaily post, “Export Markets for US Ethanol.”

The two economists reviewed the major export destinations. Brazil has been an important, but fluctuating market for U.S. ethanol that is unlikely to provide a stable source of demand for U.S. ethanol, they said. The cross trading that occurred as Brazil’s sugarcane ethanol was shipped to the U.S. to satisfy advanced biofuel requirements in the renewable fuel standard (RFS) is not likely to continue, with the changes expected in the 2014 rule. Brazil shipments to the U.S. were offset by U.S. ethanol going to Brazil to meet its blending requirements since Brazil does not distinguish between domestic and imported ethanol, the authors point out.

Advertisement

Advertisement

Canada, in contrast, has been a stable destination for U.S. ethanol, although growth is limited because, they write, “blenders are already thought to be over-complying (blending at greater than the national 5 percent blend requirement).” The Canadian market size is also relatively small at less than a tenth of the U.S. market. While the EU market holds significant potential, “tariffs, duties, and greenhouse gas reduction scores assigned to U.S. corn ethanol under the EU blending policy remain the main barriers and sources of uncertainty for future ethanol exports,” they said.

Mexico could potentially be a larger market as well. It imported 30 million gallons of U.S. ethanol in 2013, but could do more, the economists point out, as the country imported 10 times that amount of the oxygenate MTBE.

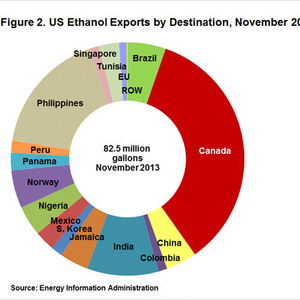

The accompanying export destination chart shows a large number of new customers for U.S. ethanol producers, along with other countries who have been out of the U.S. market for months. “Countries like Columbia, the United Arab Emirates, Jamaica and South Korea have made periodic purchases, with China making a sizeable purchase of 3.5 million gallons in November 2013. India has also been an on-again, off-again, purchaser of U.S. ethanol, picking up 13 million gallons in the last two months of 2013 after having been largely out of the US market since 2011. When priced competitively against both petroleum products and other biofuel competitors, the U.S. appears to be making export sales. However, the inconsistent nature of purchases and internal biofuel policies which sometimes favor domestic production in potential markets suggest continued export growth will require ethanol to remain both competitively priced and in a favorable policy environment.”

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events