Ethanol industry experiencing longest run of profits ever

FarmDoc Daily

March 14, 2014

BY Susanne Retka Schill

Ethanol producers have been enjoying one of their best periods of profitability ever, but the recent run of profits is unlikely to continue for an extended time, said University of Illinois economist Scott Irwin in a recent FarmDocDaily post, “Recent Trends in the Profitability of Ethanol Production.”

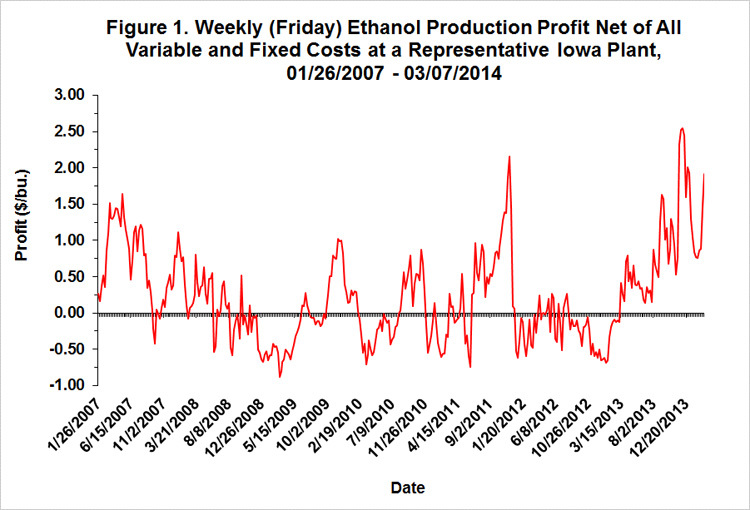

The ethanol industry has seen four extended periods of plant profitability, with the most recent one being the longest one, starting in spring 2013 to the present. “This has been driven by a drop in corn prices that substantially exceeded the declines in ethanol and DDGS prices,” Irwin said. “As a result the ethanol production industry is on a much sounder financial footing after being ravaged by drought-related losses in 2012.” Using an economic model of a representative Iowa plant, the current period of profitability has seen profits averaging 93 cents per bushel of corn processed, reaching a new high of $2.55 per bushel in early December 2013.

“There are reasons to suspect that the recent run of profits is unlikely to continue for an extended period of time,” Irwin added. One current factor is that DDGS prices have reached unprecedented levels relative to corn and soybeans. The relationship between ethanol and corn prices, however, tends to return to a long-run equilibrium, he explained. “If the ethanol price is too high relative to corn prices, then either the ethanol price must fall or the corn price must rise. For any particular episode it is difficult to know which price will bear the brunt of the adjustment, but history shows that such an adjustment is the norm.”

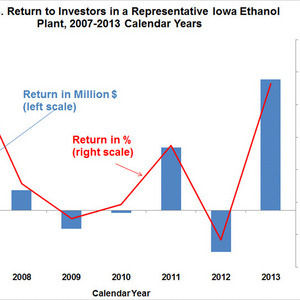

Irwin continued his analysis to look at broader trends in estimated ethanol plant profitability, looking at annual profits net of variable and fixed costs and the return to equity holders.

Advertisement

Advertisement

Irwin built his analysis using the representative Iowa ethanol plant model developed by the Ag Marketing Resource Center to track the profitability of ethanol production. For his analysis, Irwin updated some model assumptions using data from the 2012 and 2013 benchmarking studies done by Christianson & Assoc.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events