Ethanol leads The Andersons to record Q3 earnings

The Andersons

November 6, 2014

BY Susanne Retka Schill

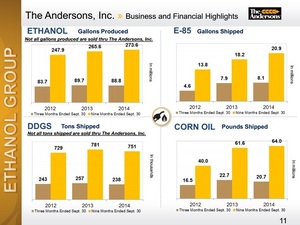

The ethanol group at The Andersons Inc. led the company’s third quarter earnings report with record Q3 operating income of $21.3 million. Overall, the company’s year-to-date earnings set a new record at $2.95 per diluted share.

"We're pleased with our results through September, which set a record. Our earnings this year clearly have been led by the outstanding results of our Ethanol Group," said CEO Mike Anderson. "I want to mention, however, that current ethanol market indications for 2015 show margins declining from the levels we have seen this year.”

Third quarter net income was $16.8 million on revenues of $1 billion, which compares to net income of $17.2 million in the same period the year earlier on revenues of $1.2 billion. Revenues were down in both the grain and ethanol groups due to lower commodity prices. The majority of the decrease was in grains, where the average price per bushel sold decreased by 36 percent, more than offsetting the 11 percent increase in bushels sold.

The ethanol group realized solid margins at all plants, supported by strong export demand, lower corn prices and solid operating metrics. The ethanol group had record E85 sales. All four ethanol plants had scheduled maintenance shut-downs during the third quarter. “These went well, and new daily production records have been set since the maintenance was performed,” chief operating officer Hal Reed said in the investor call.

Advertisement

Advertisement

“We would not expect 2015 to be another record year,” Anderson said while emphasizing the company remains positive about ethanol. The extraordinary ethanol earnings of the past year were an outcome of the drought two years ago that shut down about 15 percent of ethanol industry, drove up ethanol prices relative to corn, and created feed shortages that drove up distillers grains inclusion rates and prices. Margins going forward are returning to more normal historical levels, he explained, “as we replenished the supply of corn, replenished the supplies of ethanol and China does its thing on DDGS.” DDGS, in particular, appear to be moving back to an oversupply situation, demonstrated by the price relationship relative to corn dropping from 2014 levels of 110 percent down to levels where DDGS is priced at around 80 to 90 percent of the value of corn. That relationship is returning to pre-drought levels.

Responding to a question in the investor call, Reed said that in hedging about 50 percent of January ethanol, The Andersons are locking in margins more in line with historical levels. The company expects 2015 to see positive margins, he added, “Still strong margins, but not as good at Q2 and Q3.”

The diversified agribusiness continues to grow, acquiring Auburn Bean and Grain in north central Michigan in October. The acquisition increase the company’s grain storage capacity by 13 percent and nutrient storage by four percent. In October, The Andersons also acquired the majority of the assets in two Texas food-grade corn companies, San Antonio-based United Grain LLC and Keller Grain Inc.

The Andersons grain group is by far the largest segment of The Andersons, with the ethanol group in second place. Revenues in the grain group for the first nine months of 2014 total $1.8 billion, while the revenues for the ethanol group totaled $594 million. Revenues for all segments combined totaled $3.27 billion. The company operates four ethanol plants in Indiana, Michigan, Ohio and Iowa with a combined capacity of 330 MMgy. Other groups in the business include plant nutrients, rail, turf and specialty, and retail.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events