Ethanol production in Brazil expected to increase 9% this year

November 14, 2022

BY Erin Krueger

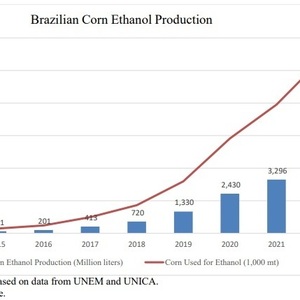

Total ethanol production in Brazil is expected to be up nearly 9 percent this year, with fuel ethanol production up by nearly 8 precent, according to a report filed with the USDA Foreign Agricultural Service’s Global Agricultural Information Network. Corn ethanol production is also expected to increase significantly.

Brazil is expected to produce 31.655 billion liters (8.36 billion gallons) of ethanol in 2022, up from 29.98 billion liters in 2021 but still below the 37.383 billion liters and 35.081 billion liters of production reported for 2019 and 2020, respectively.

Fuel ethanol production is expected to reach 28.421 billion liters this year, compared to 26.195 billion liters last year. Fuel ethanol production was at 34.407 billion liters in 2019 and 30.897 billion liters in 2020.

Brazil is expected to import only 605 million liters of ethanol this year, including 600 million liters of fuel ethanol. Imports were at 432 million liters and 427 million liters, respectively, in 2021.

The U.S. was the top supplier of ethanol to Brazil in 2021 at 269.483 million liters, followed by Paraguay at 162.535 million liters and Canada at 140,000 liters.

Advertisement

Advertisement

Ethanol exports are expected to fall to 1.55 billion liters this year, down from 1.948 billion liters in 2021 and 2.669 billion liters in 2020. Fuel ethanol exports are expected to be at 250 million liters this year, down from 300 million liters last year and 850 million liters in 2020.

South Korea was the top destination for Brazilian ethanol exports last year, at 778.44 million liters, followed by the U.S. at 465.46 million liters and the Netherlands at 118.384 million liters.

Ethanol consumption in Brazil is expected to reach 29.599 billion liters in 2022, up slightly from 29.545 billion liters in 2021. Ethanol consumption was at 34.973 billion liters in 2019 and 31.296 billion liters in 2020. Fuel ethanol consumption is expected at 27.665 billion liters this year, up slightly from 27.408 billion liters last year. Fuel ethanol consumption was at 32.848 billion liters in 2019 and 28.932 billion liters in 2020.

The overall ethanol blend rate for transportation fuel is expected to be at 49 percent in 2022, compared to 48.8 percent last year, 52.5 percent in 2020 and 54.1 percent in 2019.

Advertisement

Advertisement

Brazil currently has an estimated 337 sugarcane ethanol refineries with a combined nameplate capacity of 54.28 billion liters, compared to 343 facilities with a combined 50.5 billion liters of capacity in 2021. The country also has 18 facilities that can process both corn and sugarcane, compared to 19 last year and 11 in 2020. Capacity for these facilities is currently estimated at 5 billion liters per year, compared to 4 billion liters per year in 2021 and 2.5 billion liters per year in 2020. Capacity use for facilities that can process both feedstocks is expected to be at 48 percent this year, flat with last year.

Brazil also currently has two cellulosic ethanol plants with a combined 75 million liters of capacity, compared to three facilities with 75 million liters of capacity in 2021 and three facilities with 127 million liters of capacity in 2020. Capacity use is expected to be at 73 percent for 2022, up from 53 percent in 2021 and 25 percent in 2020.

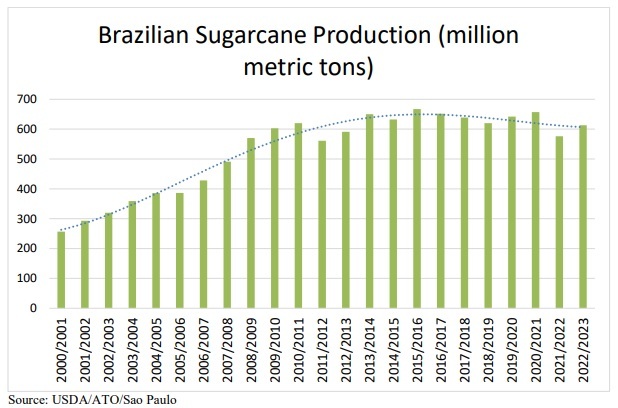

An estimated 338.75 million metric tons of sugarcane is expected to be used as feedstock for ethanol production this year, compared to 333.05 million metric tons last year. According to the report, Brazil’s ethanol producers will also process 10.791 million metric tons of corn this year, up form 7.904 million metric tons in 2021 and 5.827 million metric tons in 2020. The country’s cellulosic plants will process an estimated 306,000 metric tons of bagasse as feedstock in 2022, compared to 222,000 metric tons last year and 178,000 metric tons in 2020.

Bagasse remains the primary ethanol coproduct in Brazil, expected at 112.917 million metric tons this year, compared to 11.017 million metric tons in 2021. DDG and corn oil production are growing as corn ethanol production increases, with 3.378 million metric tons of DDGs and 194,000 metric tons of corn oil production expected this year, compared to 2.474 million metric ton and 142,000 metric tons, respectively, last year.

A full copy of the report can be downloaded from the USDA FAS GAIN website.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events