FAPRI report outlines expected growth in renewable diesel, SAF production

SOURCE: FAPRI

April 8, 2024

BY Erin Voegele

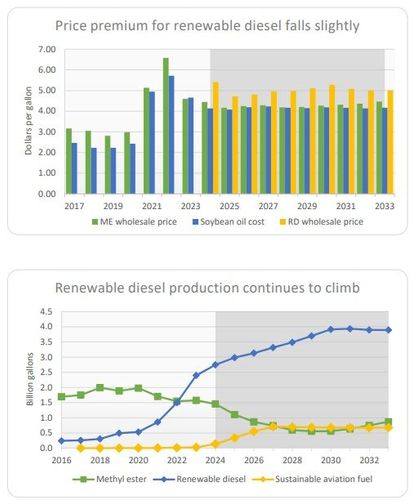

The University of Missouri’s Food & Agricultural Policy Research Institute in March released a report featuring 10-year baseline projections for U.S. agricultural markets that predicts renewable diesel and sustainable aviation fuel (SAF) production will grow over the next decade while biodiesel production declines.

The report predicts that rising production of renewable diesel over the next 10 years will increase demand for soybean oil and other fats and oils. This demand will support soybean and soybean oil prices, but put downward pressure on soybean meal prices. Demand for biobased diesel feedstocks is also expected to support increased canola oil production over the next decade.

Advertisement

Soybean prices, which were at $14.20 per bushel in 2022-’23 are projected to fall to $10.73 per bushel in 2024-’25 and average $10.57 per bushel during the 2025-’26-2033-’24 timeframe.

In making its 10-year projections for biobased diesel and associated fuels, FAPRI notes that the future path of renewable diesel expansion is sensitive to market conditions and state, national and international policies. Renewable diesel production, however, is expected to maintain a distinct production advantage over biodiesel production over the projection period despite expected lower renewable identification number (RIN) and Low Carbon Fuel Standard credit prices for biobased diesel fuels. According to the report, the spread between projected soybean oil prices per gallon of renewable fuel produced averages 13 cents per gallon for biodiesel and 87 per gallon for renewable diesel.

Renewable diesel production is expected to increase steadily over the near term, but level off in 2030. Biodiesel production is expected to decline in the near term but partially rebound toward the end of the projection period due to demand and policy initiatives. FAPRI’s analysis predicts SAF production will grow steadily through 2027, but then remain flat as tax credits are assumed to sunset. Overall biobased diesel production is expected to increase from 4.5 billion gallons in 2024 to 5.4 billion gallons in 2033.

Advertisement

Soybean oil remains a primary feedstock for biobased diesel through the projection period, increasing from 13.1 billion pounds in 2023-’24 to 16.9 billion pounds by 2033. That level of use equates to approximately 40% of feedstock share. Distillers corn oil is expected to account for approximately 12% of feedstock during the projection period, while the share of other fats and oils declines from 49% to around 44% in 2026, rebounding to 48% by 2033.

The analysis assumes modest growth in Renewable Fuel Standard blending requirements though the next decade, but assumes conventional biofuels, such as corn ethanol, will be capped at 15 billion gallons through the projection period. Biobased diesel fuels are expected to account for growth in RFS blending requirements. Renewable identification number (RIN) prices are expected to fall throughout the projection period, with prices for D4 biomass-based diesel RINs expected to average approximately 31 cents per RIN in 2033.

A full copy of the report is available on the FAPRI website.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events