FarmDocDaily post address cost of RFS compliance

FarmDocDaily

April 4, 2013

BY Erin Krueger

In a new FarmDocDaily post University of Illinois professors Scott Irwin and Darrel Good discuss the on-going cost of renewable fuel standard (RFS) compliance and the price of gasoline. In an earlier post, the two addressed the high price of D6 recent identification numbers (RINs) and the impact on gasoline prices, finding that the buying and selling of RINs within the petroleum refining and blending supply chain had little impact on RFS compliance or the retail cost of gasoline. The new post considers the larger issue of the ongoing cost of RFS compliance and gas prices.

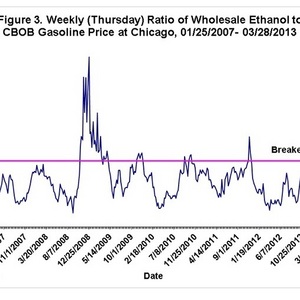

In the post, the ag economists explain that margins associated with blending and delivering E10 determine the gross cost of RFs compliance, so long as the mandate isn’t constrained by the E10 blend wall. Their analysis suggests that average annual blending margins were positive in five of the past six years, while blending margins totally nearly $14.8 billion for that entire period. Irwin and Good explain that this margin equates to approximately 2 cents per gallon for E10 blended in that period. “We can think of this 2 cents per gallon as a rough estimate of the gross benefit per gallon of gasoline to obligated parties under RFS2 over 2007-2012 that could have been passed on to consumers in the form of lower retail gasoline prices,” they say in the post.

Advertisement

Advertisement

However, the 2 cent estimate does not account for other types of costs associated with RFS compliance. Some examples of these costs include infrastructure, transportation, marketing, and administrative costs. “These costs could have been substantial and offset much if not all of the positive blending margins,” said Irwin and Good in the post. “While this certainly could have been the case, the important point with regard to present policy debates about RFS2 is that there were substantial blending margins to offset these costs. In addition, there are two other issues that impact blending margin calculations.”

First, Irwin and Good note it could be argued that blending margins were even better than their estimated 2 cents due to the advantage of ethanol over other octane enhancers. They point out that the U.S. DOE has estimated that the break-even price of ethanol for refiners was 10 percent higher than CBOB gasoline, as it is more economical to use when compared to producing more octane within the refinery. The second issue is the now-expired VEETC credit, which 53 billion gallons of ethanol were eligible for over the six years analyzed.

Regarding the E10 blend wall, Irwin and Good said in the post that RFS compliance costs could increase sharply as the wedge between the RFS requirements and blend wall increases.

Advertisement

Advertisement

The full post, titled "Ethanol Blending Margins, RFS2 Compliance, and the Price of Gasoline,” can be accessed on the FarmDocDaily website.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

Upcoming Events