Green Plains considers selling up to 3 additional ethanol plants

SOURCE: Green Plains Inc.

February 11, 2019

BY Erin Krueger

On Feb. 11, Green Plains Inc. released fourth quarter 2018 financial results, reporting net income attributable to the company of $53.5 million, or $1.13 per diluted share. The company also indicated it could sell additional ethanol plants this year.

During an investor call, Todd Becker, president and CEO of Green Plains, noted that the company’s fourth quarter and year-end results were positively impacted by the sale of three ethanol plants to Valero and the sale of its Fleischmann’s Vinegar Co. to the Kerry Group. He said the company’s actions have put the company on a solid financial footing during a period of volatile earnings.

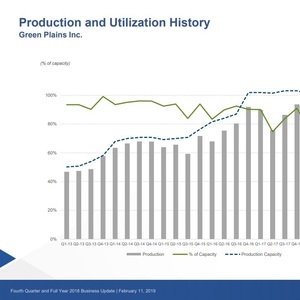

During the fourth quarter, Becker said Green Plains experienced a consolidated crush margin of negative 8 cents per gallon, which is said is the lowest in the company’s 10-year history. Green Plains produced approximately 205 million gallons of ethanol during the quarter, he added, noting that production was impacted by the sales of its plants in Bluffton, Indiana; Lakota, Iowa; and Riga, Michigan to Valero, along with the decommissioning of its plants in Hopewell, Virginia, and the temporary idling of plants as a result of the poor margin environment. Total capacity for the quarter, when adjusted for plant dispositions, would have been 327 million gallons, Becker said, noting that Green Plains new annual run rate is 1.123 billion gallons per year when operating at 100 percent capacity.

Advertisement

Advertisement

According to Becker, Green Plains exported approximately 92 million gallons, or 45 percent, of its fourth quarter production. The top destinations the company shipped to during the quarter were India, Canada and Brazil. For 2018, Green Plains exported 254 million gallons, or approximately 23 percent of its ethanol production. That export volume accounts for approximately 15 percent of the total ethanol gallons exported by the U.S. last year, he added.

Regarding the possibility of selling more of the company’s assets, Becker said nothing is imminent, but noted the company could see one or more transactions occur before the end of the second quarter in support of the company’s previously announced optimization plan.

Advertisement

Advertisement

During the question and answer segment of the call, Becker said the company’s original goal was to sell four to six ethanol plants. It has already sold three. According to Becker, Green Plains is currently working with six different counterparties on several different locations. He said the company is currently looking to sell an additional one to three additional ethanol plants over the next three or four months in an effort to raise an additional $100 million to $200 million in asset sales.

Green Plains reported net income attributable to the company of $53.5 million, or $1.13 per diluted share, for the fourth quarter of 2018, compared to net income of $46.6 million, or 99 cents per diluted share, for the same period of 2017. Revenues were $827.5 million for the fourth quarter, compared to $921 million for the same period of the previous year.

For the full year 2018, revenues attributable to the company were $3.9 billion, compared to $3.6 billion for 2017. Net income for 2018 was $15.9 million, or 39 cents per diluted share, compared to net income of $61.1 million, or $1.47 per diluted share, for 2017.

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events