Green Plains reports record earnings, 34 cent margin for Q1

Green Plains Renewable Energy Inc.

May 1, 2014

BY Susanne Retka Schill

Green Plains Renewable Energy Inc. reported yet another quarter of record earnings. Net income for the first quarter of 2014 was $43.2 million, or $1.04 per diluted share, compared to $2.6 million, or 8 cents per share, in the same period in 2013. Revenues were $733.9 million in Q1 compared to $765.5 in Q1 2013.

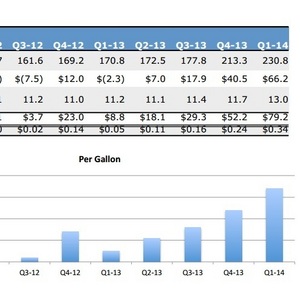

Green Plains' ethanol production segment produced 230.8 million gallons of ethanol in Q1, running at approximately 95.5 percent of its daily average production capacity. Overall, the company’s ethanol margin was 34 cents per gallon in Q1, compared to 24 cents in the previous quarter. Green Plains acquired three plants in 2013, bringing the idled 115 MMgy Fairmont, Minn., ethanol plant acquired in November into production in early January. A fire in the dryer building at Fergus Fall interrupted production for a few days, but the plant is running normally now, selling wet distillers as repairs continue on the damaged system.

Non-ethanol operating income, from the corn oil production, agribusiness and marketing and distribution segments, was $41.1 million in the first quarter of 2014 compared to $21.2 million for the same period in 2013.

Advertisement

Advertisement

Green Plains had $229.9 million in total cash and equivalents and $138.5 million available under committed loan agreements at subsidiaries (subject to satisfaction of specified lending conditions and covenants) on March 31. First quarter 2014 EBITDA, which is defined as earnings before interest, income taxes, depreciation and amortization, was $94.1 million compared to $24.8 million for the same period in 2013.

In remarks during an investor call, CEO Todd Becker described the impact of several events on the company’s Q1 report. Transportation bottlenecks resulted in unusually high finished ethanol inventories, totaling about $22 million in deferred profits that will mostly be reported in Q2, although with some offsets. Responding to the spike in natural gas prices, Green Plains idled ethanol production for short periods and took the opportunity to sell some of the unused natural gas at peak prices. Its Blendstar subsidiary rack business was able to capitalize on the short-term ethanol shortages, Becker said, “While we made certain that our regular customers never ran out.”

Looking out into the next couple of quarters, Becker told the investors that the company is 80 percent hedged for the second quarter. “We’ve also seen strengthening margin environment for the third quarter and have 50 percent hedged there. 2014 should be overall a strong year. Gasoline demand is at the higher end of the five-year average,” he continued, saying that should result in 13.5 to 13.8 billion gallons of ethanol. On top of that, strong interest from several countries was indicating ethanol exports should range between 800 million to over 1 billion gallons.

Becker also reported that Green Plains is asserting more control on the day-to-day operations of its BioProcess Algae joint venture. A number of the obligations for the U.S. DOE grant have been met, with encouraging results on the work on algae oil for military fuel. “Our main focus is still on higher value animal feed and human food,” he added. Several products are showing potential, and discussions are underway with potential partners. Possible products include omega 3 oils, extracted high oleic powders for chemicals, as well as algae for aquafeed, among others. With progress being made on the technology front, Becker added over the next two years the company will need to decide whether to partner or internalize the algae project, or shut it down if it ultimately proves unprofitable. “I’m confident we can achieve profitable results based on what we’ve seen,” he added.

Advertisement

Advertisement

In answering questions from investors at the end of the call, Becker painted a positive outlook for 2014 and beyond. “The market will continue to pull to higher blends,” he predicted, pointing out that ethanol remains competitive at 50 to 80 cents per gallon under RBOB. He projected positive long term growth for the ethanol industry, noting E15 will be the impetus to get to a national average of E11. In addition, global demand is up. “We’re seeing demand from Canada, Africa, the Middle East, Mexico,” he said, “and China is always the wild card.”

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events