GRFA: Ethanol production does not drive food prices

Global Renewable Fuels Alliance

May 31, 2017

BY Global Renewable Fuels Alliance

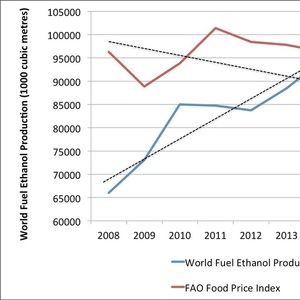

The Global Renewable Fuels Alliance recently released a new chart showing opposite trends in the UN Food and Agriculture Organization Food Price Index and world fuel ethanol production since 2008, demonstrating clearly that ethanol production is not a main driver of global food prices. The chart uses the latest world fuel ethanol production data from F.O. Licht’s 2017 forecasts.

The FPI’s steady and significant drop to 161.5 points in 2016 since peaking at 229.9 points in 2011 has paralleled the drop in annual oil prices over the same period. West Texas Intermediate annual figures show that oil prices have dropped from $94.88 in 2011 to $43.15 in 2016.

By contrast, this decline in food prices has coincided with a period of record ethanol production expansion, rising from 87 billion liters (22.98 billion gallons) in 2011 to 98.5 billion liters in 2016, a 16 percent increase over this period. This disparity clearly demonstrates that increased ethanol production does not drive food prices.

“Real world data has long contradicted speculation about ethanol production driving up food prices,” Baker said. “These latest figures should finally put to rest any “food vs. fuel” concerns with ethanol production and are consistent with findings by the World Bank which concluded that almost two thirds of food price increases are caused by rising oil prices,” he added.

Advertisement

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events