Marathon reports improved Q1 earnings for renewable diesel

SOUCE: Marathon Petroleum Corp.

May 7, 2025

BY Erin Krueger

Marathon Petroleum Corp. on May 6 reported improved first quarter EBITDA for its renewable diesel segment on increased utilization of its facilities, particularly the Martinez biorefinery in California, and higher margins.

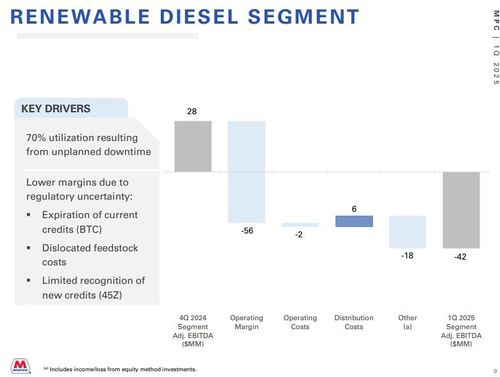

Segment adjusted EBITDA for the first quarter was a $42 million loss, compared to a $90 million loss reported for the same period of 2024. Renewable diesel margins were $26 million, compared to a $5 million loss. Marathon defines renewable diesel margins as sales revenue plus value attributable to qualifying regulatory credits earned during the period less the cost of renewable inputs and purchased product costs.

During a first quarter earnings call, Marathon Chief Financial Officer John Quaid said the company’s renewable diesel facilities ran at approximately 70% capacity utilization during the first quarter, mainly as a result of unplanned downtime at both the Martinez facility, which is operated via a joint venture with Neste, and the company’s biorefinery in Dickinson, North Dakota.

Advertisement

Advertisement

According to Quaid, the changing tax credit structure was the most significant headwind faced by the renewable diesel segment during the first quarter. Regarding operations, he said the company is working to optimize operations at the Martinez facility to operate at nameplate capacity while leveraging flexible logistics and pretreatment capabilities to enable a diverse slate and margin. He also noted the company has addressed operational issues that limited production during the first quarter, with both biorefineries positioned to run well during the second quarter.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events