Neste reports increased SAF production volumes, low renewables margins for Q1

SOURCE: Neste Corp.

April 29, 2025

BY Erin Krueger

Neste Corp. released first quarter financial results on April 29, reporting improved renewable fuel demand and increased sustainable aviation fuel (SAF) production. Margins, however, were low and feedstock costs were high.

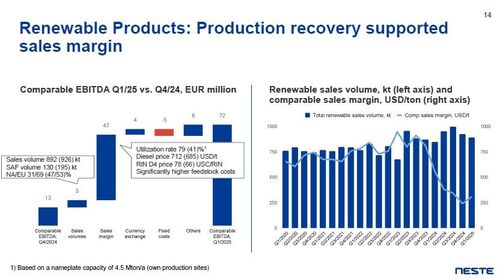

The comparable sales margin for renewables fell to $310 per ton during the first quarter of 2025, down from $562 per ton reported for the same period of last year. Neste primarily attributed the decline to global overcapacity that affected prices and strong feedstock demand, which kept input prices high.

Production at all of Neste’s biorefineries was stable during the quarter, and SAF production at the Rotterdam facility ramped up as planned, according to the company. Neste’s own renewables production facilities operated an average utilization rate of 79% during the three-month period, down from 88% during the first quarter of 2024, as production volumes were optimized. The share of waste and residue inputs was 97%, up from 91%.

Total renewable fuels production reached 1.11 million metric tons during the fourth quarter, including 877,000 metric tons of renewable diesel, 207,000 metric tons of SAF and 29,000 metric tons of other products. Total renewable fuels production during the same period of last year was at 1.14 million metric tons, including 933,000 metric tons of renewable diesel, 167,000 metric tons of SAF and 35,000 metric tons of other products.

Advertisement

Neste sold 892,000 metric tons of renewable fuels during the first quarter, up from 849,000 metric tons during the same period of 2024. SAF accounted for 130,000 metric tons of that volume, up from 41,000 metric tons.

During the first quarter, approximately 69% of renewable diesel and SAF volumes were sold into the European market, up from 51% during the same period of last year. Only 31% of sales volumes were destined for North America, down from 49%.

Neste said U.S. biobased diesel production was subdued during the first quarter, citing reduced run rates as a result of prolonged regulatory uncertainty and the changing tax credit structure. In Europe, renewable diesel market tightness eased during the three-month period as refineries returned to production following outages.

Advertisement

According to Neste President and CEO Heikki Malinen, comparable EBITDA for renewable products fell to EUR 72 million during the first quarter, down from EUR 242 million during the same period of last year. He primarily attributed the decline to weaker margins. Malinen also noted that Neste’s SAF sales are expected to increase towards the end of 2025, reflecting the seasonality of demand and the SAF annual mandate structure.

Malinen briefly discussed Neste’s ongoing expansion project at its biorefinery in Rotterdam, noting the project is proceeding according to the updated plan. When complete in 2027, the biorefinery is expected to be the world’s largest facility production renewable diesel and SAF, he said. Neste currently has 1.5 million metric tons of SAF capacity in place, including the recent addition of 500,000 metric tons of SAF capacity at Rotterdam.

For the full year 2025, Neste currently predicts that renewable products sales volumes will be higher than last year.

A full copy of Neste’s first quarter report is available on the company’s website.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events